Master Excel-Based Cost Calculation and Business Analysis Practice! PART-III

dymanagementlab

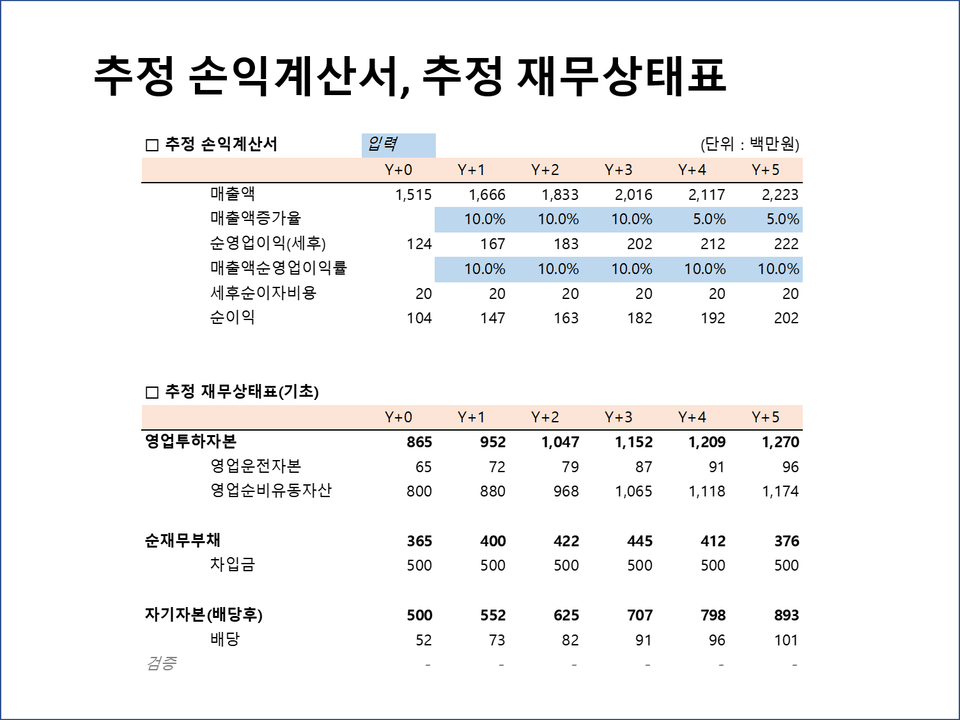

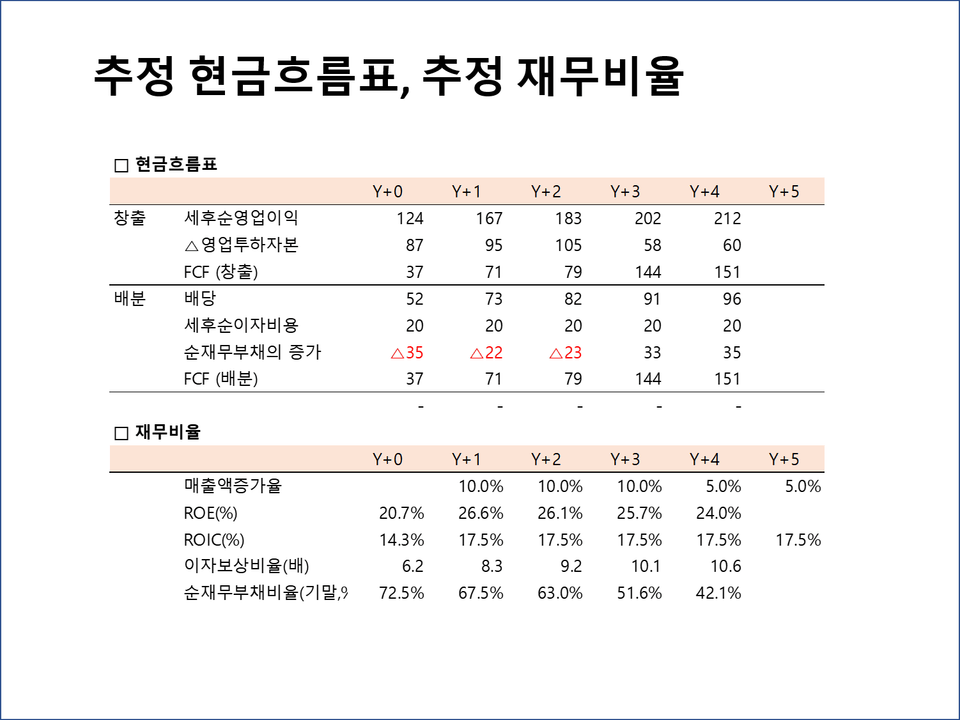

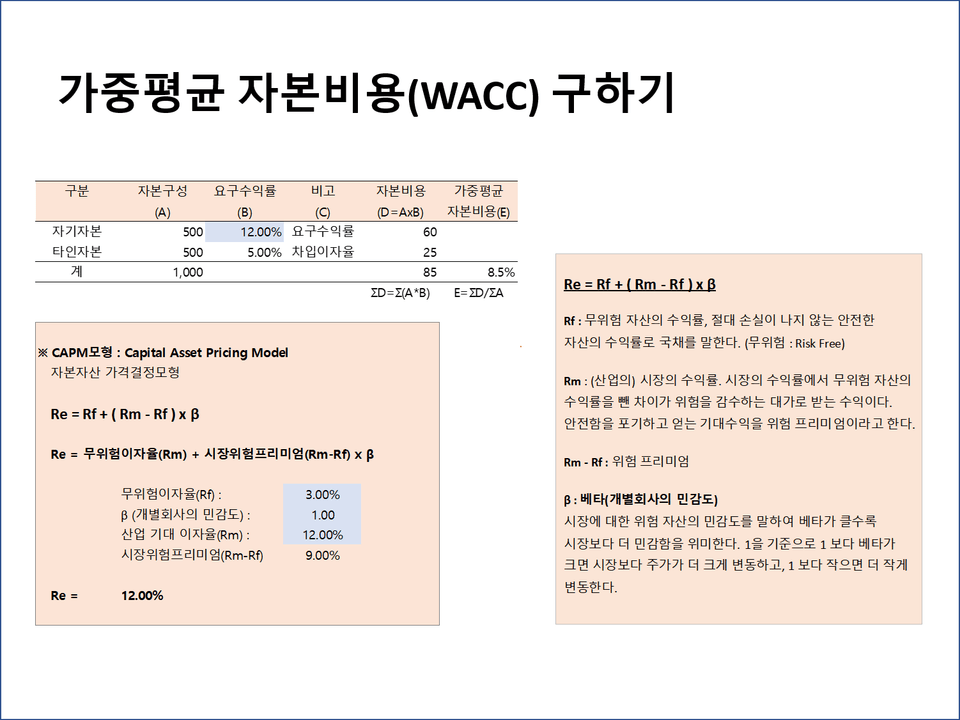

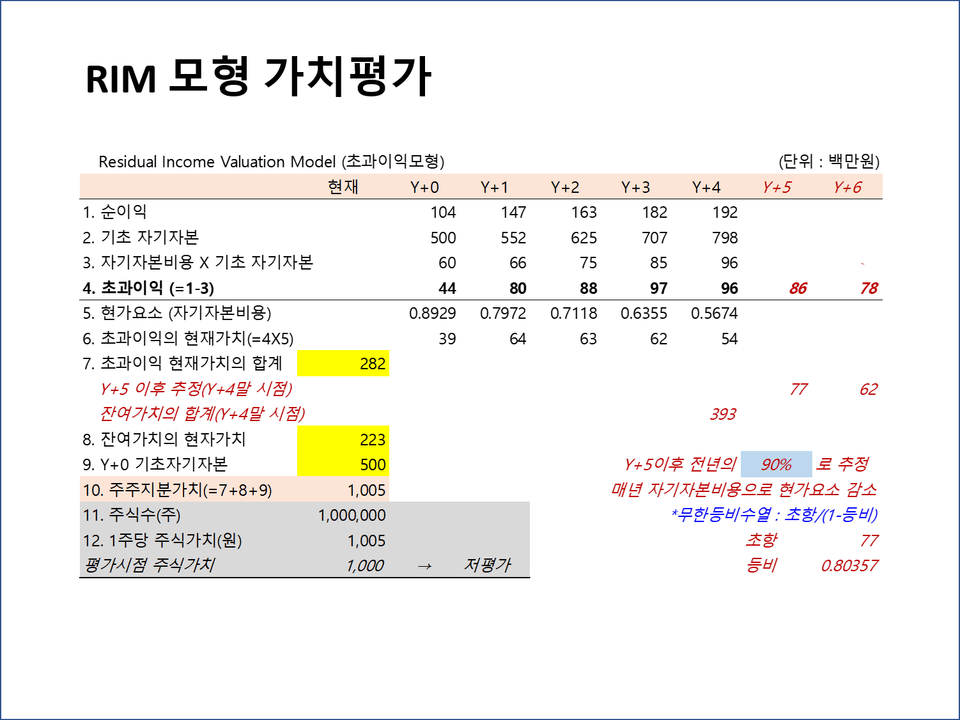

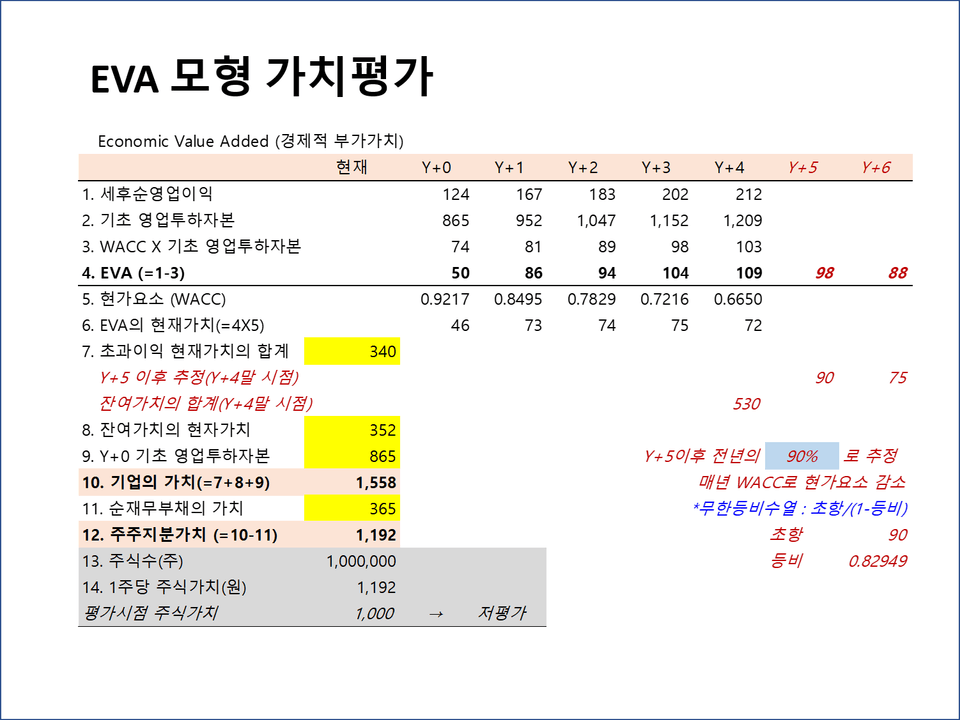

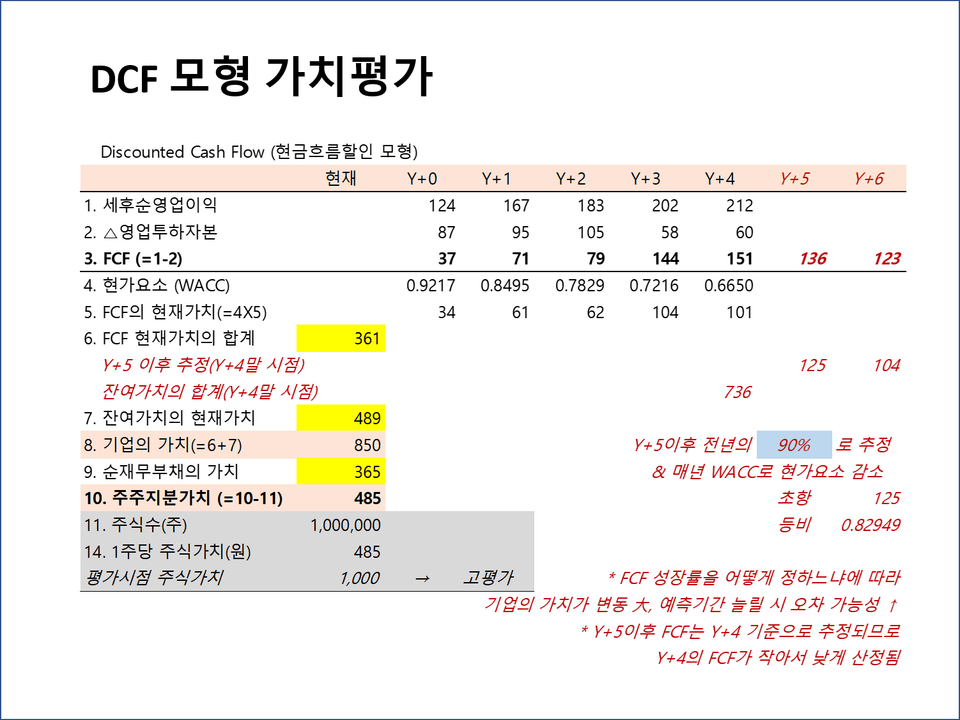

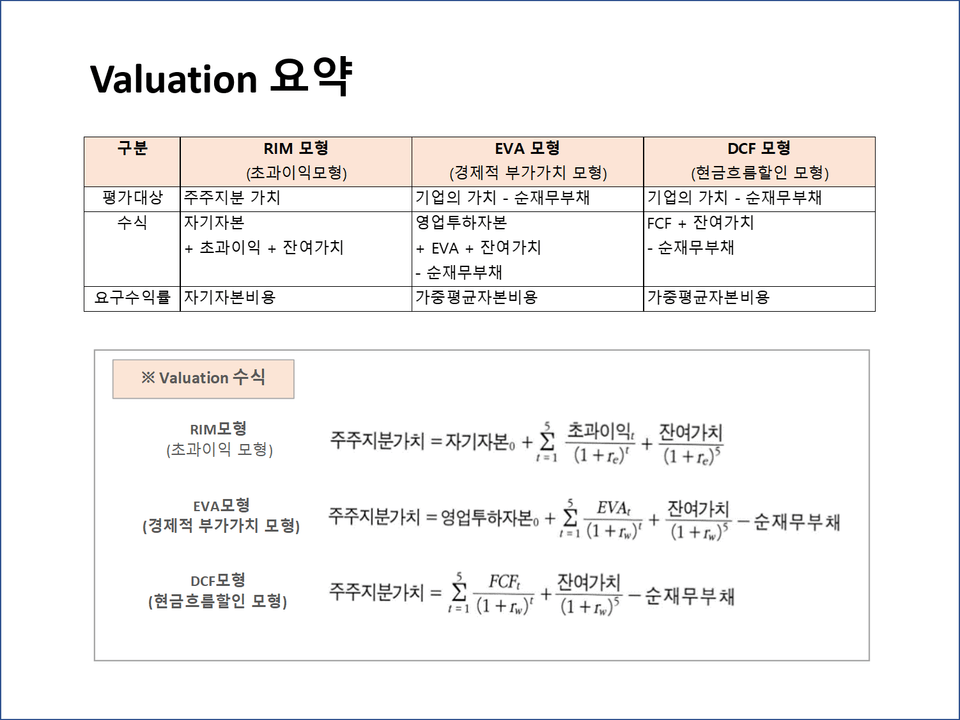

We'll take a very practical and easy approach to cost accounting and management analysis using Excel, which you may have found difficult before. This course covers the following topics: - Cost Accounting from Basics to Practice: Step-by-step learning from cost concepts, standard costs, actual costs, to indirect cost allocation - Understanding Financial Statements and Accounting Flow: From manufacturing cost flow to accounting treatment and financial statement generation process - Strategic Pricing Methods: Pricing strategies by market type and profitability analysis by product - Analyzing Management Indicators with Excel: Break-even point analysis and financial ratio analysis practice - Management Decision-Making Based on Management Accounting: Short-term/long-term business planning and business feasibility analysis practice

Basic

Excel, Accounting, Management

![[Sebasi] Yanadoo's 7 Principles of Success | CEO Kim Min-cheolCourse Thumbnail](https://cdn.inflearn.com/public/files/courses/338313/cover/01k1arc172eqbxrzq4a03k6ejk?w=420)

![[Kim Jae-sung's Q&A Episode #3] How would a McKinsey alum sell 200 thermal imaging cameras that remained in inventory for 2 years? (with #McKinsey #Seoul National University #Cheil Worldwide #Kakao Strategy alumni)Course Thumbnail](https://cdn.inflearn.com/public/files/courses/340171/cover/01kdbtshnk1b88ksfwywk8cgz6?w=420)