Creating my own web page with Python Part 1

quanttrader

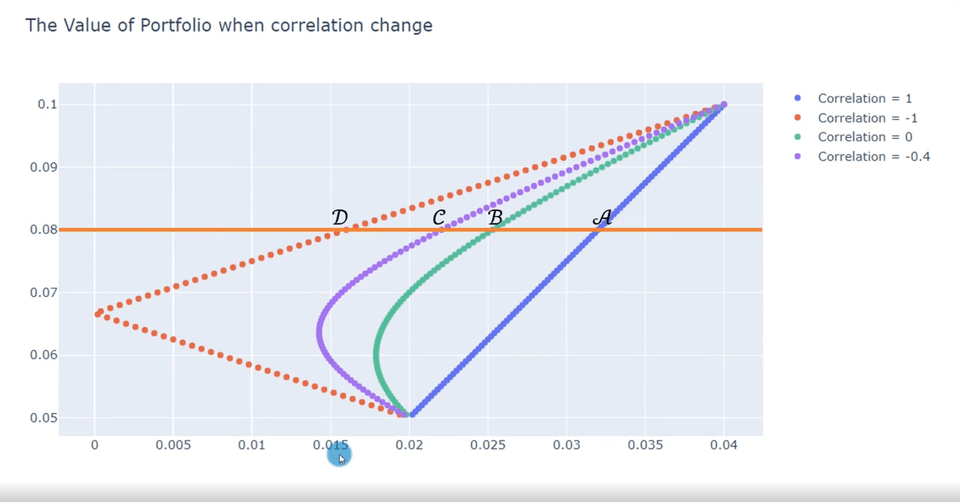

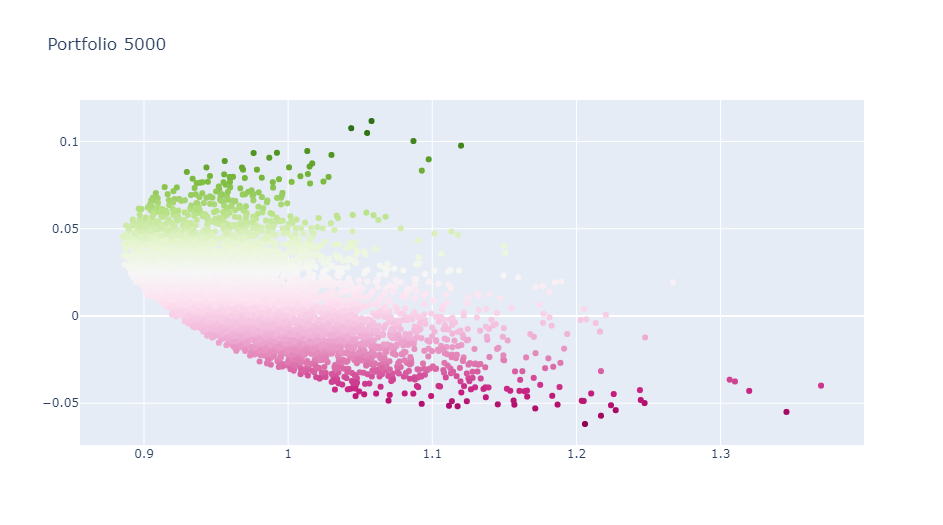

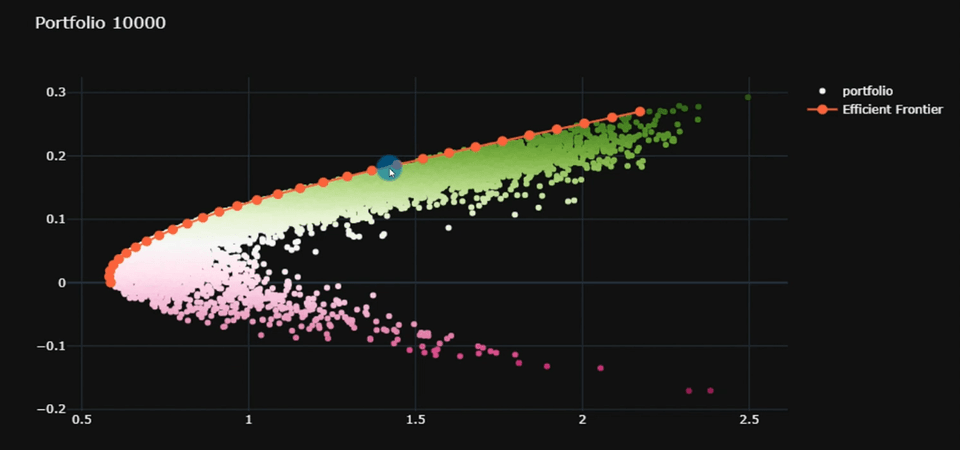

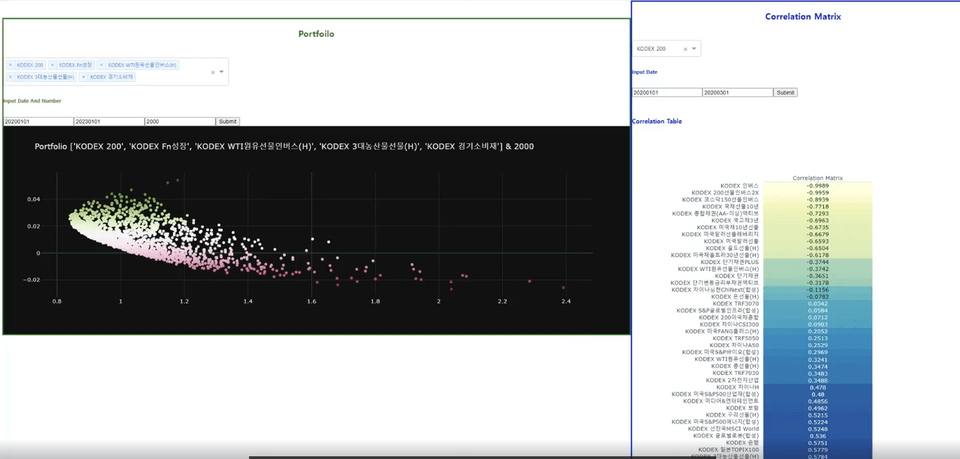

Now display Python results as web pages! You can create your own web page using only Python. This is an opportunity to create an Interactive Dashboard that allows you to check results created with Python, such as data analysis and machine learning, on a web page!

초급

Python