Success as a Startup (Introduction to Startup CFO Course)

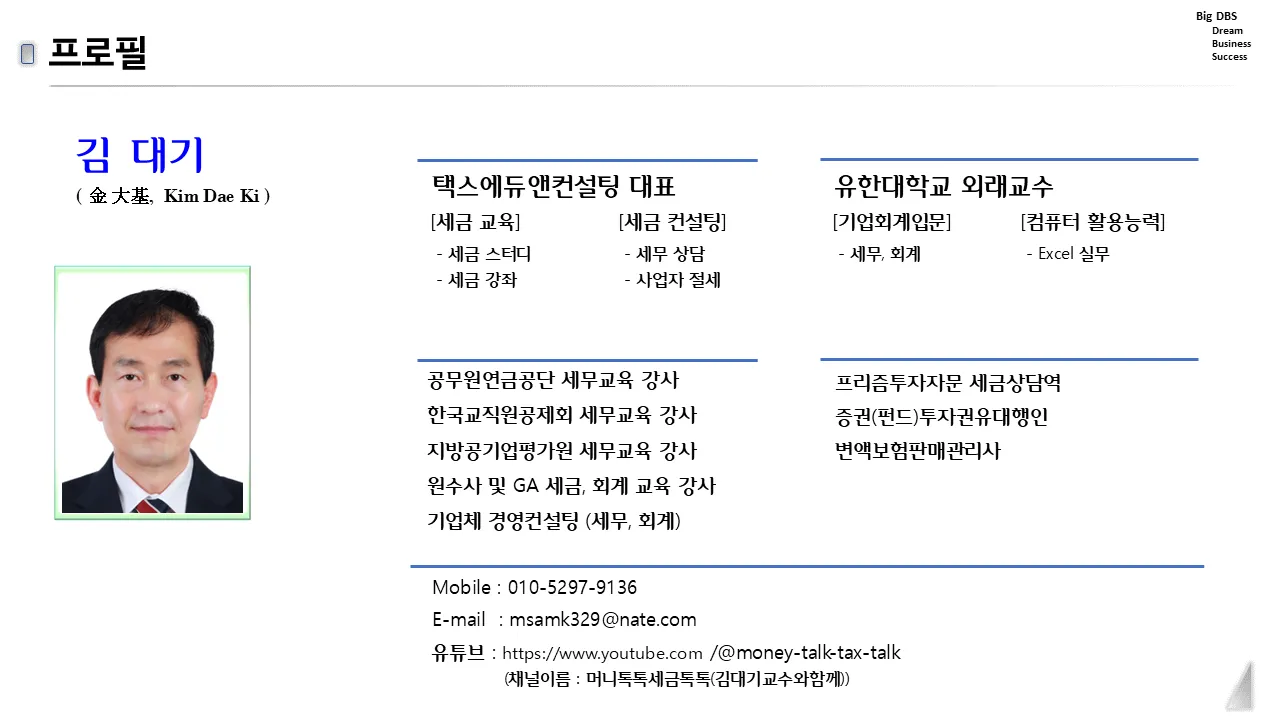

cfoschool

The founding CEO can be the main culprit of startup failure. Understand and fill the role of the CFO who lowers the failure rate and increases the success rate of startups!

입문

Financial Management, CFO

![[Employee Asset Management] Real Estate Tax Reduction Strategies강의 썸네일](https://cdn.inflearn.com/public/files/courses/337792/cover/01jxvxxasvmsf979vq3xpk8qg6?w=420)

![[Online Class Creation] Revealing the know-how behind creating 7 online classes!강의 썸네일](https://cdn.inflearn.com/public/courses/328105/cover/b4f5ff8d-e8f5-48ba-adcf-76e1fac5d6e4/328105-eng.png?w=420)