![[Basic Tax Guide] for Freelancers and YouTubersCourse Thumbnail](https://cdn.inflearn.com/public/courses/324857/course_cover/784e8eb0-e3a4-48c2-8583-c2a93d28c703/djm-tax.jpg?w=420)

[Basic Tax Guide] for Freelancers and YouTubers

deuxamismain5176

We have prepared a basic lecture on taxes that you must know as you live in the world :)

Beginner

Accounting, Financial Technology, Taxation Business

This course will help you file your comprehensive income tax return for your housing rental income of 20 million won or less, either in writing or electronically. You will also learn how to save on health insurance premiums for your housing rental income.

How to calculate income related to housing rental

Calculation of health insurance premiums related to housing rental

How to Calculate Income Tax on Housing Rental Income

How to file a comprehensive income tax return for housing rental income

How to calculate taxes on rental income from housing and how to file income tax returns ,

And here are some tax saving tips 💵

Previously, income tax and health insurance premiums were exempt from taxes on rental income of up to 20 million won. However, starting in 2019, comprehensive income tax will be imposed on rental income of up to 20 million won . Therefore, you must file and pay your comprehensive income tax between May 1 and June 1, 2020.

This lecture covers the income tax calculation method that a housing rental business operator with a housing rental income of 20 million won or less should know.

This lecture is about how to file an income tax return and is very useful for the following people.

- Housing rental business operators with housing rental income of 20 million won or less

- Those who wish to file their comprehensive income tax return electronically and whose housing rental income is less than 20 million won

- Those who wish to operate a housing rental business in the future

- Those who want to know whether health insurance premiums are imposed on rental income

- Those who wish to save on health insurance premiums imposed according to housing rental income tax

- Housing rental business operators who want to know about income tax calculation and reporting methods for other housing rental income.

By taking this course, you will be able to file a comprehensive income tax return in writing and electronically for rental income of up to 20 million won, and learn how to save on health insurance premiums.

This course consists of five lecture topics, and the lecture structure is as follows.

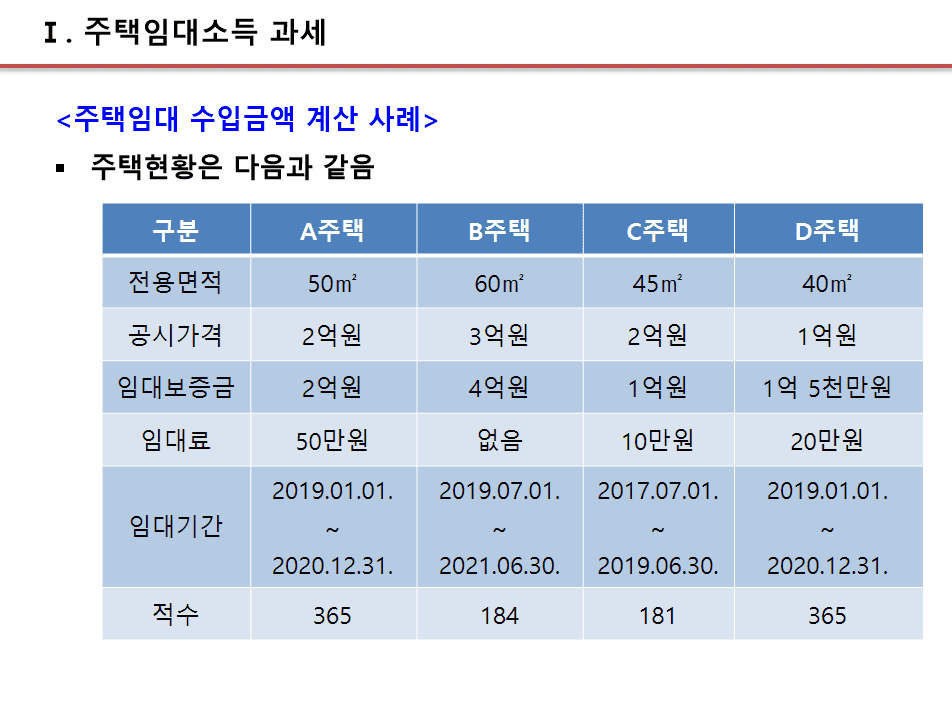

This explains the method of calculating rent and deemed rent corresponding to the amount of housing rental income.

This explains how to calculate comprehensive income tax by distinguishing between registered and unregistered rental business operators based on rental income from housing.

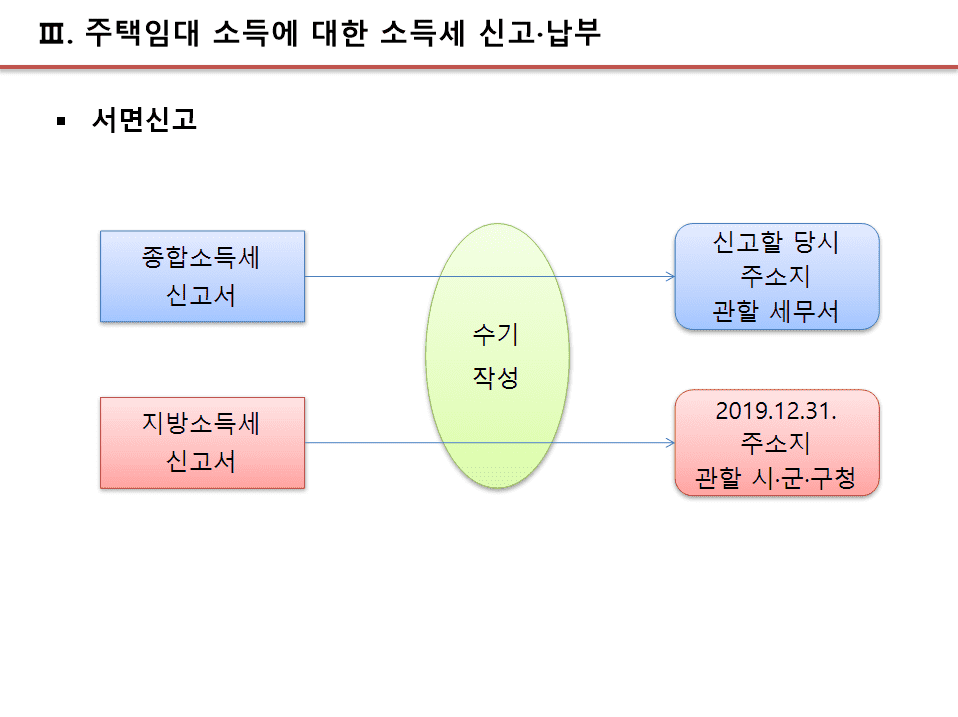

This section explains how to file income tax returns for housing rental income of 20 million won or less using the Comprehensive Income Tax Return form.

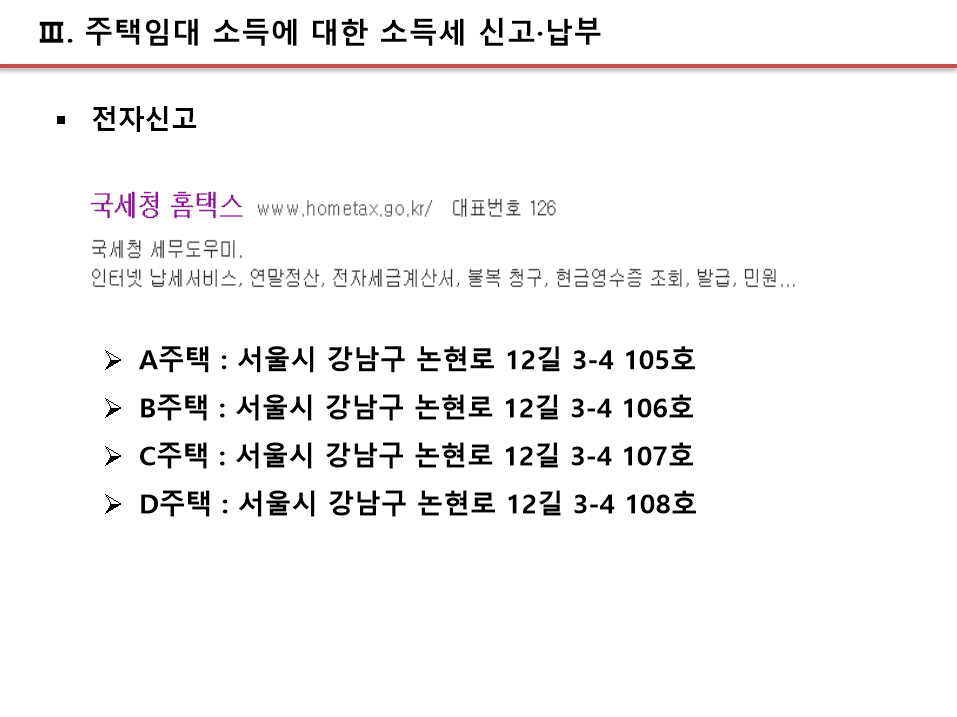

This explains how to report rental income of less than 20 million won on the National Tax Service's Hometax.

Starting in November 2020, health insurance premiums will be levied on rental income. We will explain how to reduce these premiums.

Who is this course right for?

A housing rental business operator who generates housing rental income of less than 20 million won

A person who reports comprehensive income tax on housing rental income of less than 20 million won

A person who wishes to engage in a housing rental business

Housing rental business operators who do not pay health insurance premiums as dependents

Need to know before starting?

doesn't exist

세무법인 화우에서 세무사로 근무하고 있으며

다양한 업종의 장부작성 및 세금 신고 대행을 하고 있습니다.

특히, 부동산매매업 및 주택임대업에 대한 세무처리가 전문입니다.

All

6 lectures ∙ (1hr 52min)

Course Materials:

All

2 reviews

4.5

2 reviews

Reviews 1

∙

Average Rating 4.0

Reviews 1

∙

Average Rating 5.0

5

I have been studying business and accounting, but I was curious about this area, and I learned it here. Thank you.

Yes, hello. I'm glad it helped. Thank you.

Limited time deal ends in 3 days

$7,700.00

30%

$8.80

Explore other courses in the same field!