Master Excel-Based Cost Calculation and Business Analysis Practice! PART-III

dymanagementlab

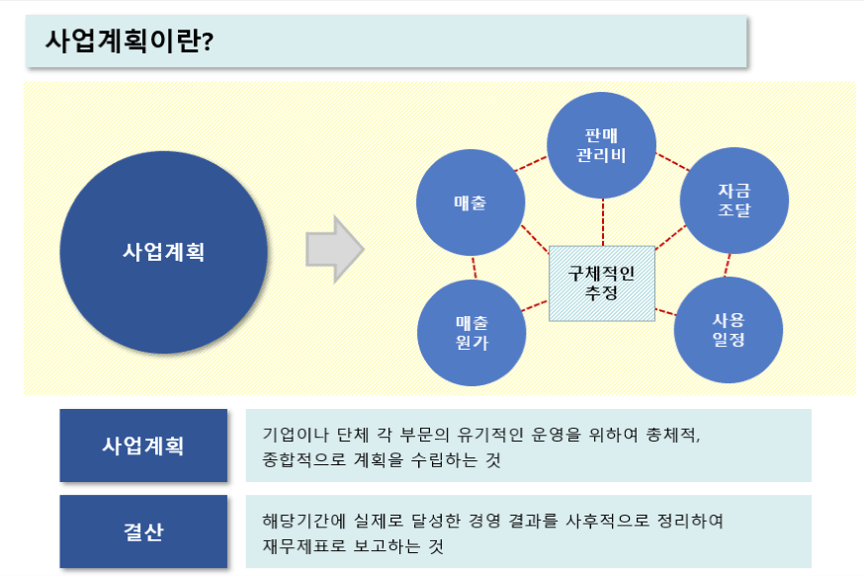

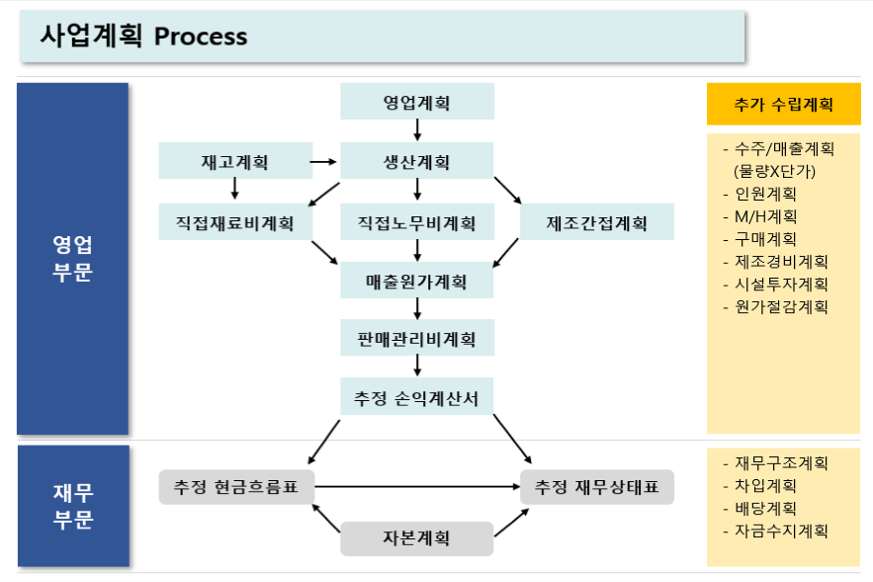

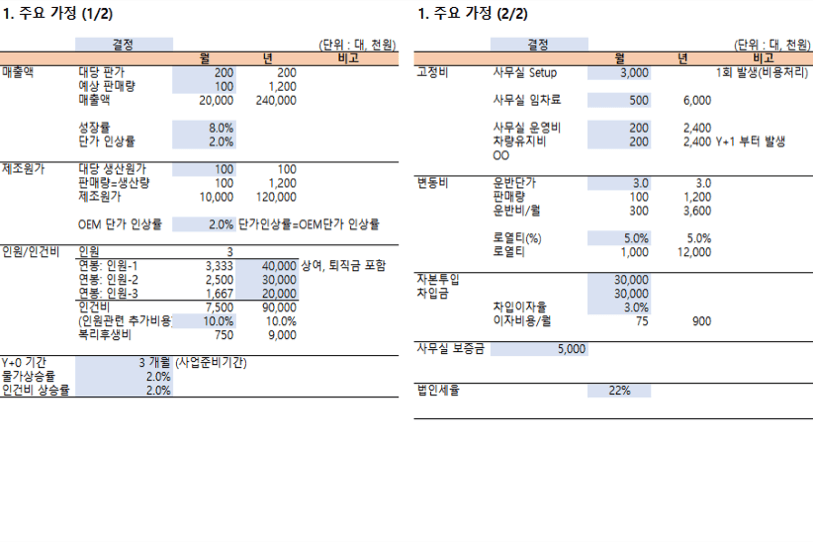

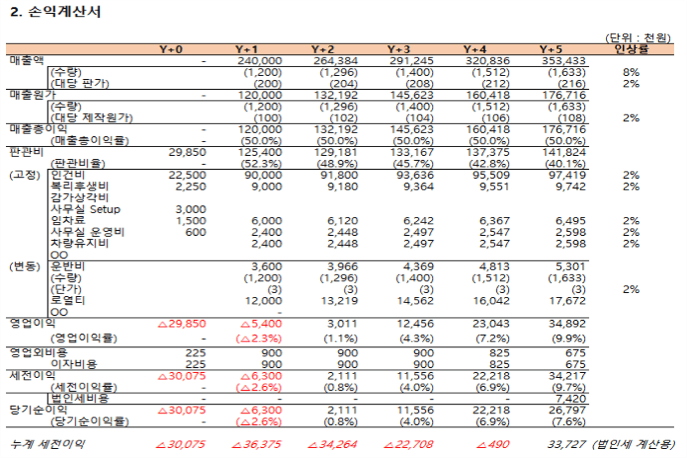

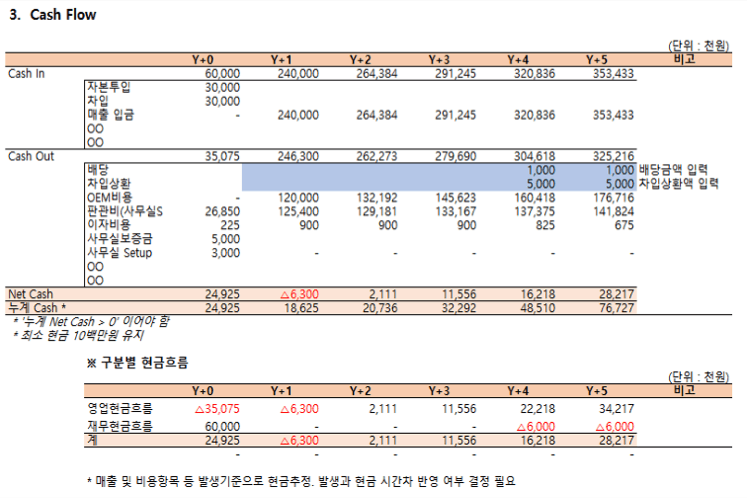

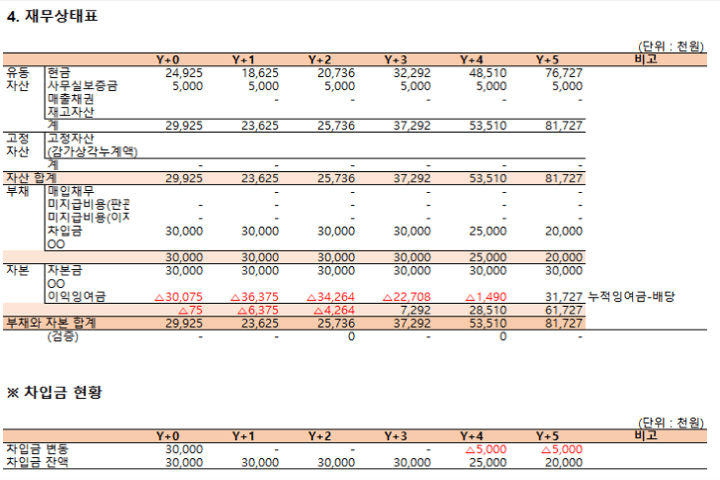

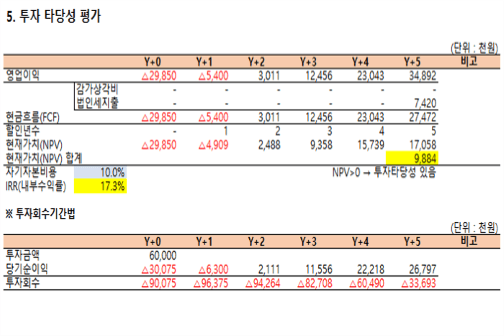

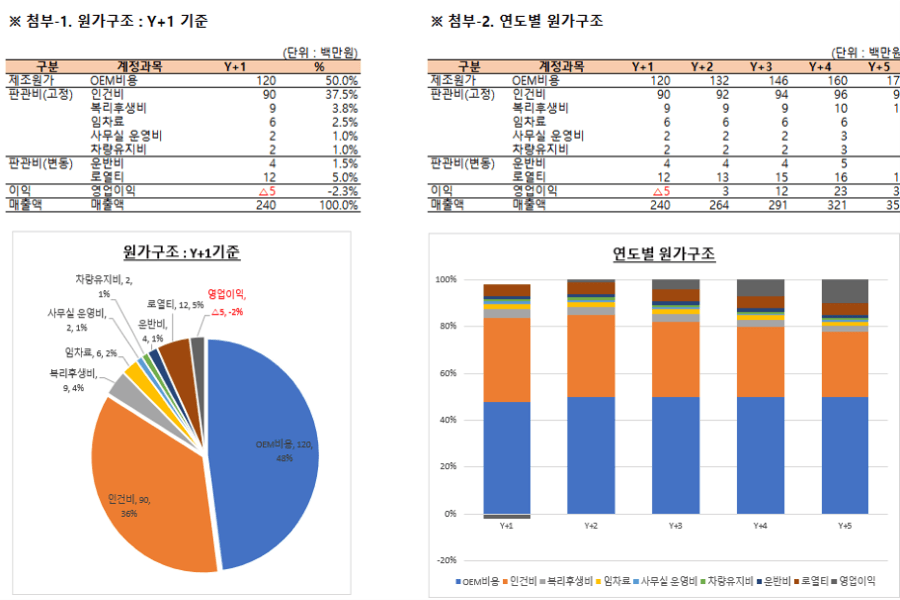

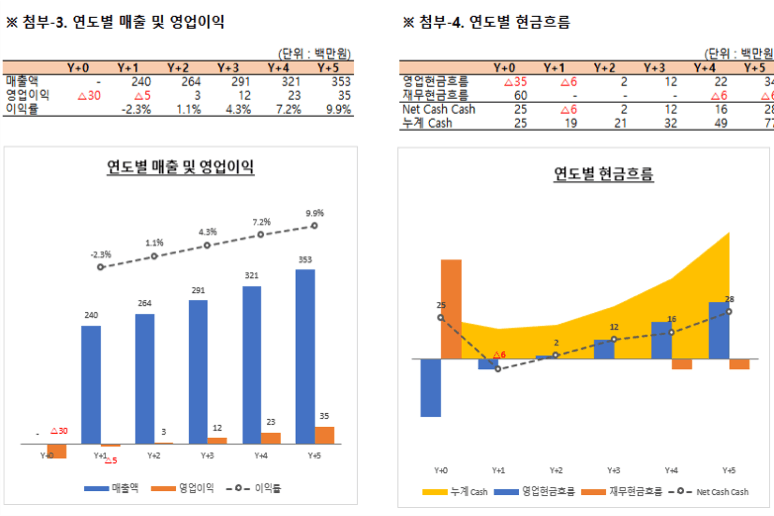

We'll take a very practical and easy approach to cost accounting and management analysis using Excel, which you may have found difficult before. This course covers the following topics: - Cost Accounting from Basics to Practice: Step-by-step learning from cost concepts, standard costs, actual costs, to indirect cost allocation - Understanding Financial Statements and Accounting Flow: From manufacturing cost flow to accounting treatment and financial statement generation process - Strategic Pricing Methods: Pricing strategies by market type and profitability analysis by product - Analyzing Management Indicators with Excel: Break-even point analysis and financial ratio analysis practice - Management Decision-Making Based on Management Accounting: Short-term/long-term business planning and business feasibility analysis practice

초급

Excel, Accounting, Management