실무자를 위한 데이터 시각화

MCA 연구센터

데이터를 다루는 방법은 무엇이 더 아름다운지를 느끼는 감각보다 우리의 시각적 지각을 통해 더 잘 접근합니다. 그래서 데이터 시각화의 지각적 특성을 파악하는 것이 인간의 선호도를 통해 알아차리는 것보다 유리합니다. 따라서 이 강의를 통해 실무에 적합한 데이터 분석과 그래픽 커뮤니케이션을 구축하고자 합니다.

입문

R

Attention to those who want to study stocks! But, you are studying stocks without knowing financial engineering? How about learning how to make money properly through financial engineering from the basics?

Financial Engineering

stock

Quant

If you say you're studying stocks, you've probably been scammed at least once, where you pay money and receive strange 'flyers' or learn ridiculous techniques that make you feel like you're going to become rich.

It may seem absurd, but you shouldn't make such choices blinded by money. These methods might seem like a quick win, leading you to believe they're making money, but in the long run, they're quite risky.

I believe these things happen because we lack the resources to develop our own secrets or properly study stocks. I hope this financial engineering course will empower you to analyze and study stock data using a mathematical approach .

Also, for developers interested in studying quantitative analysis or developing automated stock trading programs , consider this fundamental material and consider spending time studying it together.

It's no exaggeration to say we live in a stock market era. It's self-evident that studying the theoretical aspects before studying stocks is a good idea. The answer lies in financial engineering.

Financial engineering is a discipline that studies and mathematically analyzes derivative products such as stocks and securities.

I think it would be good to study more meaningful 'investment' through this financial engineering.

• The lectures are conducted at a level suitable for beginners.

• It enhances understanding of the content through various examples.

• Presents uncluttered content through a clean PPT.

• Theory and practice will be covered separately for each course.

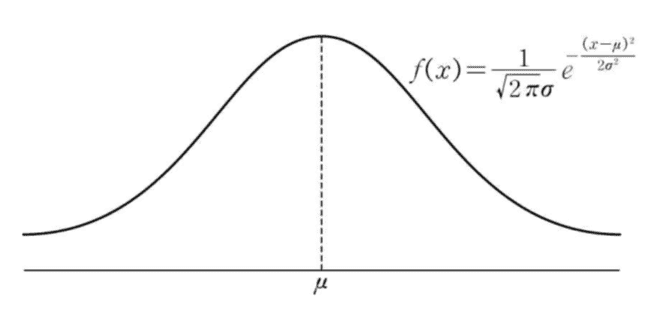

Before studying financial engineering, you'll learn the fundamentals of probability and random variables. This will help you understand the nature of probability and calculate expected values.

• Among the concepts of random variables learned in Unit 1, we will cover continuous random variables and, most crucially, the concept and properties of normal random variables. This will help you understand the relationship between the binomial and normal distributions and aid in your understanding of geometric Brownian motion.

• You will understand the concepts and characteristics of geometric Brownian motion and Brownian motion, and learn about the similarities and differences between the two. This will help you understand the information needed to predict future stock prices.

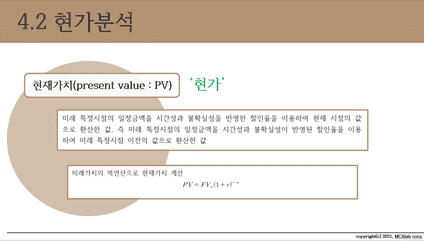

• Learn the fundamental concepts of financial engineering and understand them through various examples. This will help you understand the basic concepts and calculate present value and rates of return.

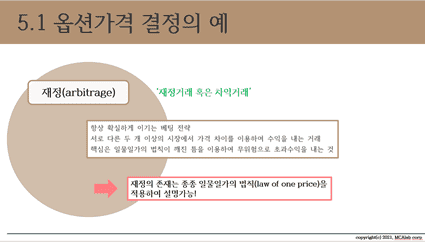

• Learn the concepts of options and finance and see how finance is used to determine prices in a variety of models, including the single-period binomial option model.

• You will learn about the no-finance principle and use it to find the no-finance price of a unique option in a multiperiod binomial distribution model.

Q. Can non-majors also take the course?

A. Yes, of course. Even if you're not a math major, it won't be difficult because it'll be explained step-by-step from the beginning.

Q. Why should I study financial engineering?

A. If you want to approach stocks mathematically and make meaningful investments, I recommend financial engineering. It's also essential for those interested in studying the current hot topic of quant analysis.

Q. What kind of jobs can I get if I study financial engineering?

A. You can develop quantitative and automated trading programs through financial engineering.

Q. Is there anything I need to prepare before attending the lecture?

A. None. All you need is the determination to follow along diligently.

Who is this course right for?

For those who want to study stocks properly

Anyone who wants to study financial engineering

For those who wish to study financial mathematics

For those who wish to study quant

95

Learners

7

Reviews

4.1

Rating

2

Courses

회사 소개

MCA 연구센터는 맞춤형 기업 컨설팅(연수교육, 데이터분석가 양성 컨설팅), 암호 알고리즘 연구 및 블록체인 플랫폼 개발 회사입니다.

- 국가기관 연수교육 : 사무관 및 실무 공무원 대상 통계학, 데이터분석 강의

- ㈜아이티고 온라인 교육: 데이터 분석 및 통계학 강의, 암호학 강의

(경영 빅데이터 분석사, 재무 빅데이터 분석사, ADSP, ADP, 통계직 공무원 대상 통계학등)

- ㈜위브앱솔루션 : 앱개발 고급통계 기법 및 알고리즘 기술자문

- 퀀트 및 금융 관련 앱 개발 스타트업 기업 : 알고리즘 트레이딩, 퀀트 관련 기술 자문

- 성균관대 대수센터 참여연구 (과제: 타원곡선과 그 적용 문제 연구(암호학관련))

- 카이스트 참여연구 (과제: 보형형식의 산술성 및 분할수 연구)

All

16 lectures ∙ (4hr 46min)

Course Materials:

All

4 reviews

3.5

4 reviews

Reviews 1

∙

Average Rating 3.0

Reviews 11

∙

Average Rating 5.0

Reviews 155

∙

Average Rating 5.0

Reviews 4

∙

Average Rating 4.0

1

이론강의 강의라고 기입이되야할듯합니다 수학공식을 알려주는 강의는 유튜브로 들어도 될듯한데. 전체강의를 이론 공식 강의하면 초보자가 무슨 재미로 듣겠습니까? 이런분께 추천한다는 4가지 조건과 강의가 맞다고생각하시는지요? 4강까지 참고 들었는데 마지막까지 설마설마했는데 너무 돈 아깝습니다. 유료강의 이래서 듣겠습니까? 정말 돈내고도 엄청 짜증이 나는 말도 안되는 강의를 돈받고? 수강평이 없는 이유를 알겠습니다 . 환불해주세요

강의 평 믿지마세요. 수학공식 설명하는 강의입니다. 아무런 도움이 되지 않습니다. 강의가 아니라 수학공식 풀이입니다.

$22.00

Check out other courses by the instructor!

Explore other courses in the same field!