문서로 커뮤니케이션하는 직장인 평생 생존스킬. 문서 구조화와 시각화

그로스쿨

강사님께서 가공하여 만든 각 분야의 문서 예제를 보고 문서를 보는 관점을 기르는 방법을 연습합니다.

초급

프레젠테이션

Account disclosure! Approaching the core of the ‘All Weather Strategy’, the world’s No. 1 hedge fund’s authentic asset allocation investment.

The world's No. 1 hedge fund's authentic asset allocation 'All Weather Strategy'

The most classic asset allocation method used by Ray Dalio's Bridgewater

Lecture 1: Instructor Introduction and Orientation

Lecture 2: All-Weather Strategy Special Lecture

-Our investment

-Hedge fund rankings

-Bridgewater's Fund

-Two ways to make money

-beta

-Alpha

-Dante's All Weather Portfolio

Understanding the Investment Flow of the Three Major Elements (1): Stocks, Funds, and Bonds

-Stock investment

-Index funds (or ETFs)

-Are US stocks trending upward?

-Are global stocks trending upward?

-Which country's stocks do you buy?

-Can I just buy stocks?

-Stocks' Friends: Bonds

-Backtest

-8% yield

-Risk Parity

-When both bonds and stocks are destroyed

-Interest rate

Understanding the Four Major Investment Flows (2): All Weather, TAA

-Rebalancing

-All-weather strategy

How to buy US ETFs

-realization

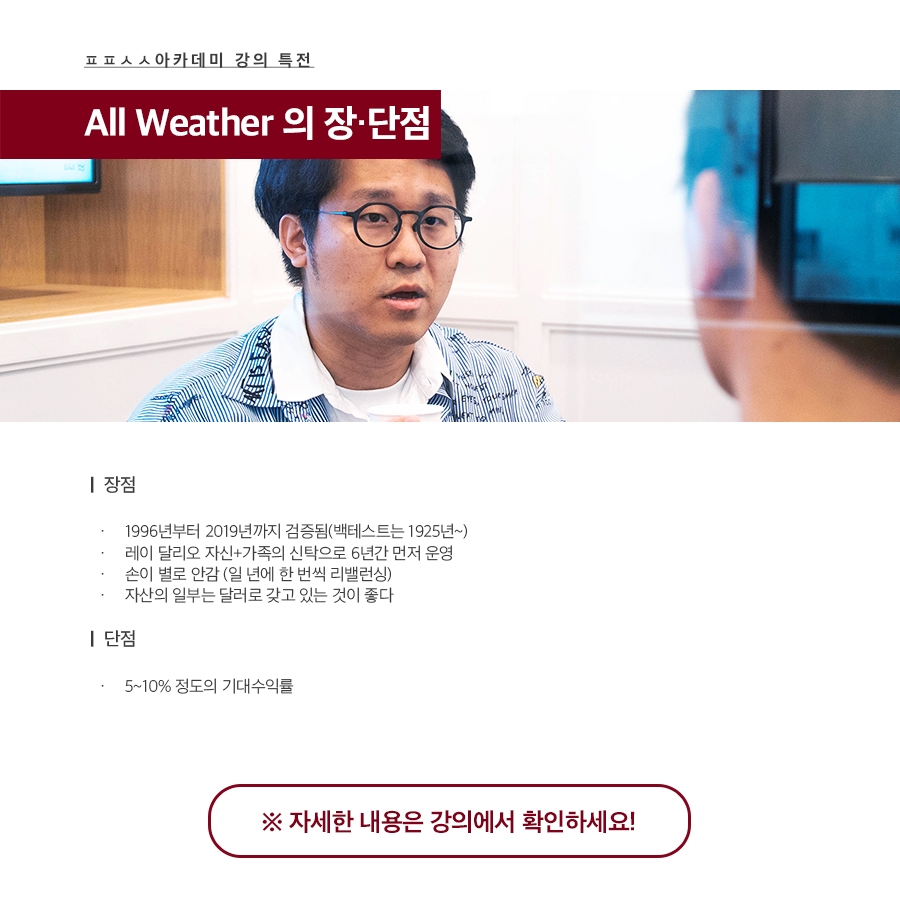

- Pros and Cons of All Weather

-FAQ

-Philosophy of asset allocation

- Difficulty in market timing

-TAA

"The stock market was really, really beautiful. At worst, the price of a car would fluctuate like that in a single day. I just kept watching stocks every day, and eventually I sold them. I became a stock trader who got cussed out for only watching HTS at work."

"Ray Dalio runs the world's number one hedge fund, and the company operates exactly two funds: one alpha and one beta. Studying beta investing and Ray Dalio is so much fun."

"I really worried a lot about how to manage my money. But I ended up falling for Ray Dalio. He's the best, so I'll do the same."

Who is this course right for?

Investors interested in the theory and concepts of asset allocation

Individual investors who are interested in financial investment and can invest time

Investors who want returns commensurate with their efforts

Need to know before starting?

Willingness to invest

All

4 lectures ∙ (1hr 27min)

Course Materials:

All

1 reviews

4.0

1 reviews

Reviews 2

∙

Average Rating 4.0

4

소개가 좋은 강의

안녕하세요:) 단테님은 픗픗아카데미에서만 주기적으로 강의를 하는데 들어주셔서 너무 감사합니다. 나경권님의 투자생활에 앞으로 -가 없고 골고루 분산하셔서 +만 있는 투자생활 하시길 바라겠습니다!

Check out other courses by the instructor!