Curriculum

Dynamic Asset Allocation Strategy Using ETFs

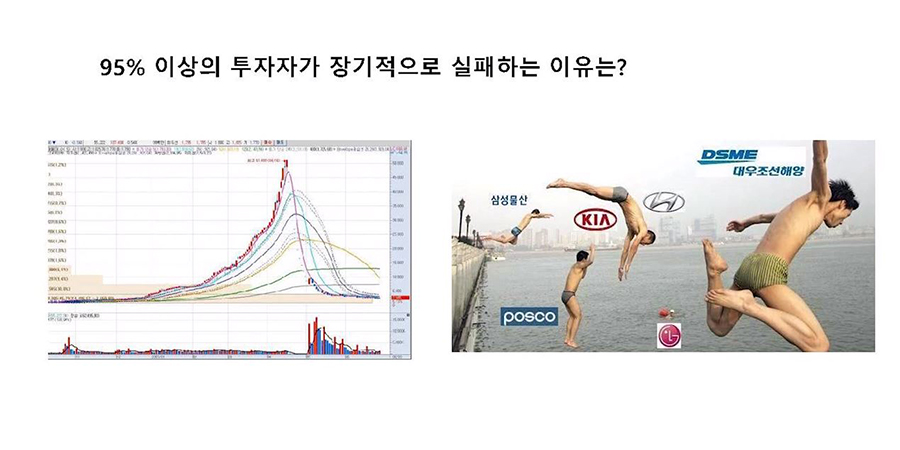

Why do over 95% of investors fail in the long run?

-Why are you ruined by stocks?

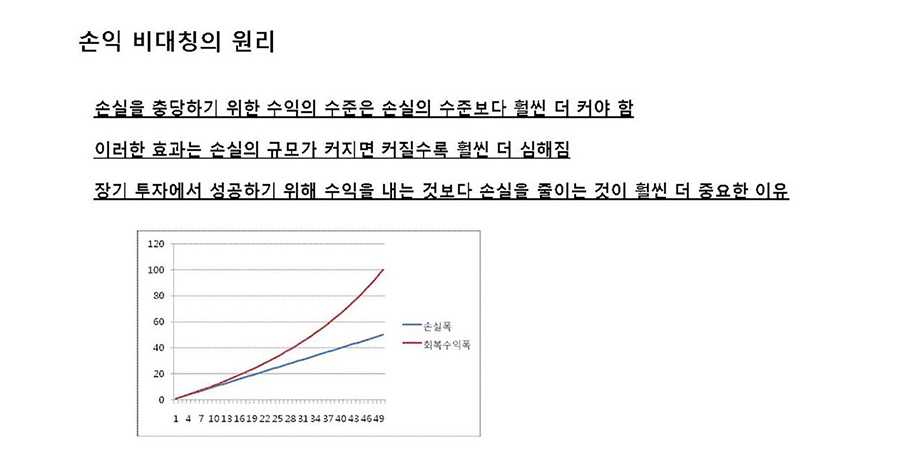

-Making a profit vs. not losing

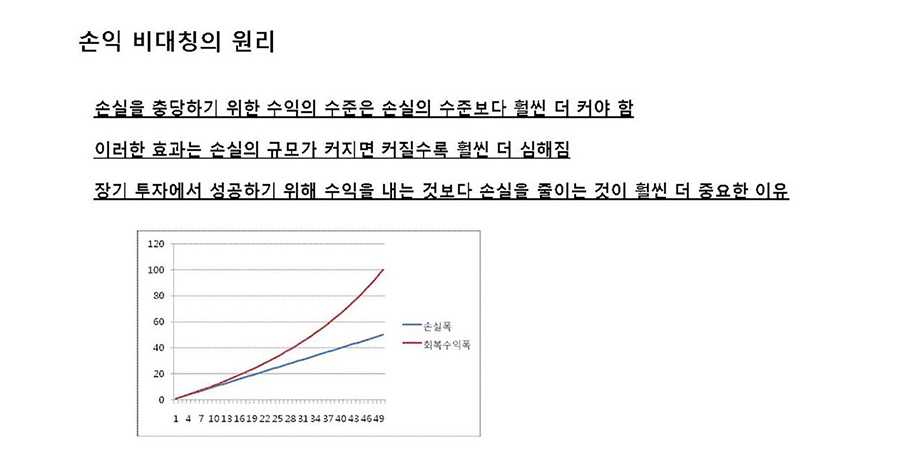

-The principle of profit and loss asymmetry

How to Succeed in 3-Strength Investment

-Diversified investment

- Mixing with different assets

-Trend following

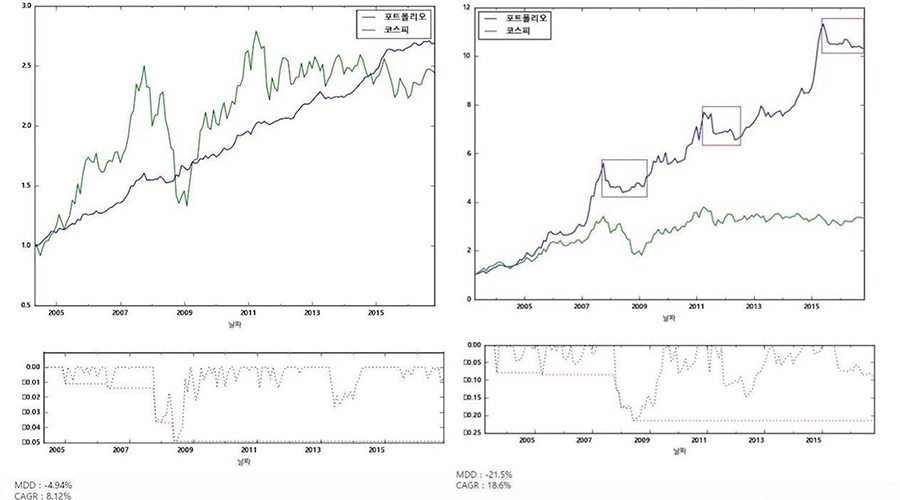

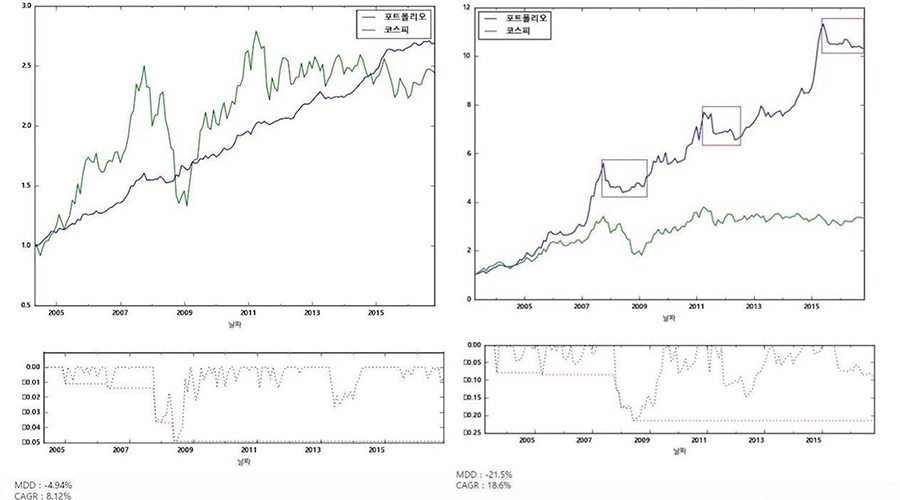

Weight adjustment according to the trend following the 4 major markets

-Absolute momentum strategy

-Relative momentum strategy

-Dual momentum strategy

-Average momentum score strategy

MPAA Strategy Conclusion: Improving the 5-Strength Momentum Strategy

-Long-term absolute returns

-The key to successful investing

-The core of loss limitation

Q&A on the 6th floor

Lecture Features

- Be humble in the market! Investments are so easy and safe that even elementary school students can understand them!

PPSS's PICK

"You need to think carefully before investing. Many people just buy and try. Then, analyzing economic news and the Dow Jones Industrial Average won't make their funds rise."

"Our country's investment community is so obsessed with technique that they've forgotten the most important thing. For long-term investment success, minimizing losses is far more important than generating profits."

"Just remember these three key points. Once you understand these three things, you can apply them to any trading situation, from short-term to medium- and long-term. And you can even apply them to your life."

Instructor Interview

.png?w=420)