증권사 출신이 해설하는 금융위기와 양적완화 Case Study

금융트럭

1. 경제와 금융시장 이슈와 이에 대한 해설을 제공합니다 2. 경제와 금융이슈를 해석하는 방법론을 제공합니다 3. 이해와 해석을 통해 독자분들의 자산관리/재테크에 반영할 수 있게됩니다

초급

투자, 재테크

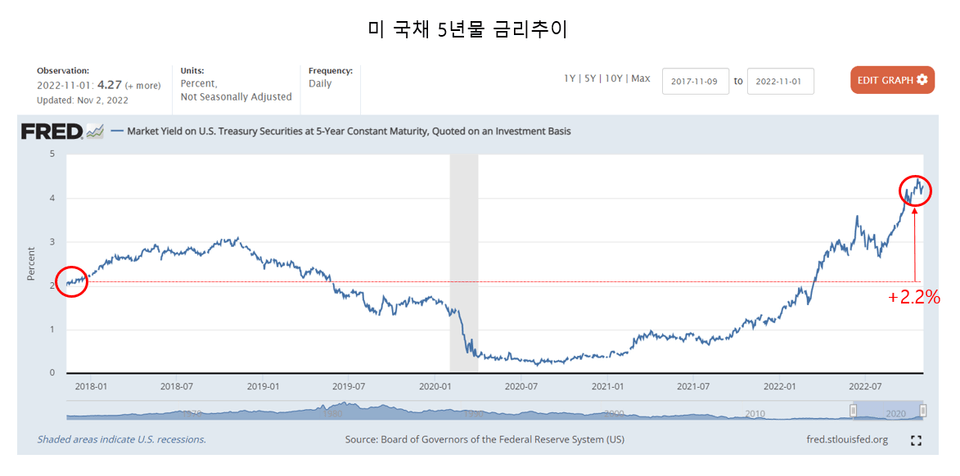

We will inform you about the three Big Issues (British Pound/Government Bond Crash, Legoland PF ABCP Crisis, Heungkuk Life Insurance New Capital Securities Call Option Crisis) that detonated a nuclear bomb in the domestic and global financial markets in the second half of 2022.

Last fall, we learned about the causes, progression, and consequences of the collapse of the British pound and government bonds.

Learn about the full story of the Legoland PF ABCP incident

You will learn what the non-exercise of Heungkuk Life Insurance's new capital securities call option is.

In the global financial market in the second half of 2022

Let's find out the 3 big issues that caused the nuclear bomb to explode 😵💫

Issues in the financial markets are constantly emerging and disappearing. While most are merely a tempest in a teacup and fade away, some bring about significant changes in the market. I planned this lecture with the belief that learning how to interpret these issues will help readers manage their assets and make financial investments in the future.

.png?w=960)

✔️ We provide easy-to-understand information using diagrams and pictures, even for those who are not familiar with economics and finance.

✔️ We help students understand by explaining things in simple terms rather than using industry jargon.

✔️ This is not a superficial lecture, but a lecture full of real information taught by someone with experience in the securities industry.

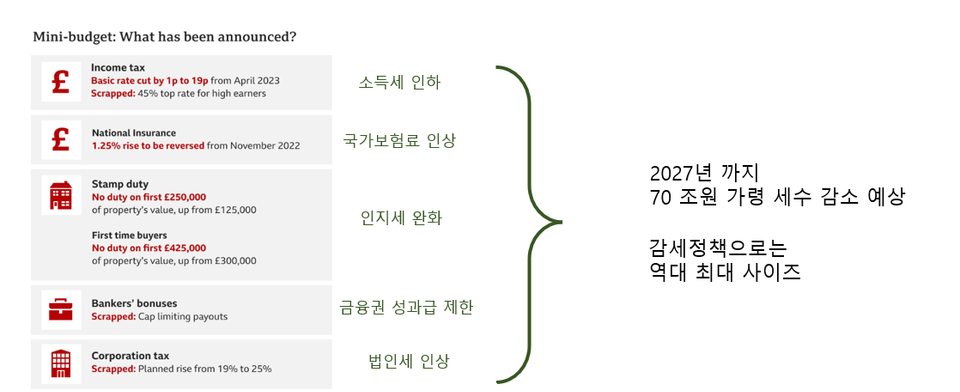

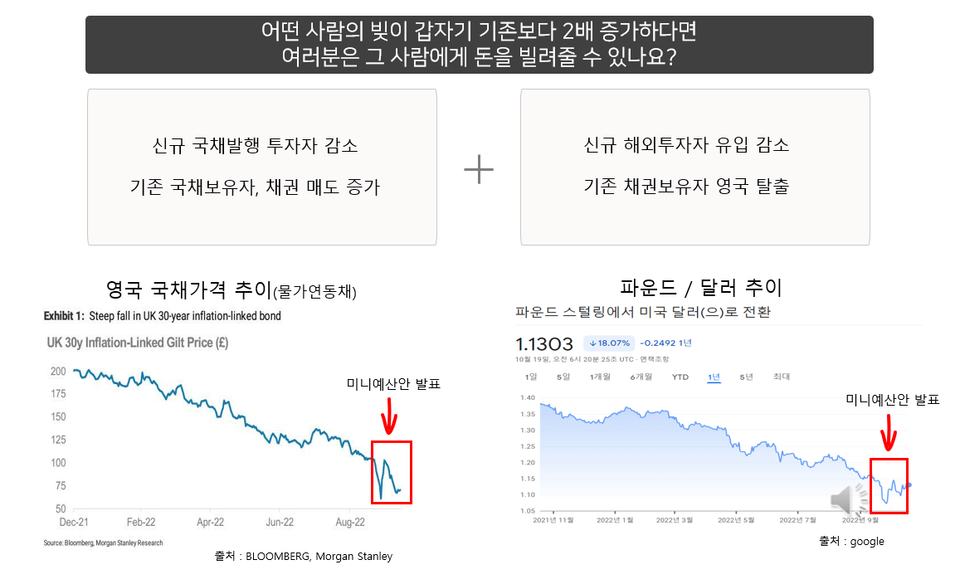

We explore the collapse of the British pound and British government bonds that occurred in the fall of 2022, following the arrival of a new British Prime Minister and Cabinet.

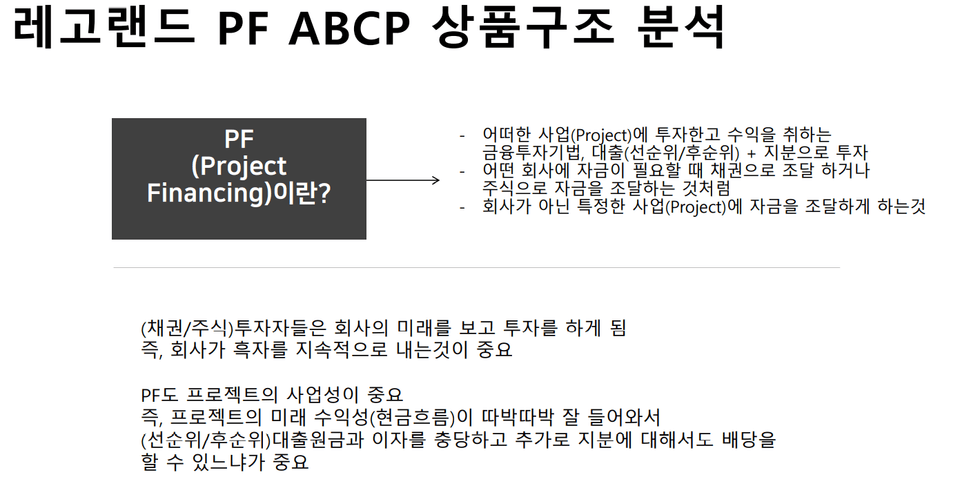

Learn about the full story behind the Legoland PF ABCP crisis and the connections between the Legoland crisis, the Dundun Public Housing redevelopment project, and the real estate PF ABCP market's funding crunch.

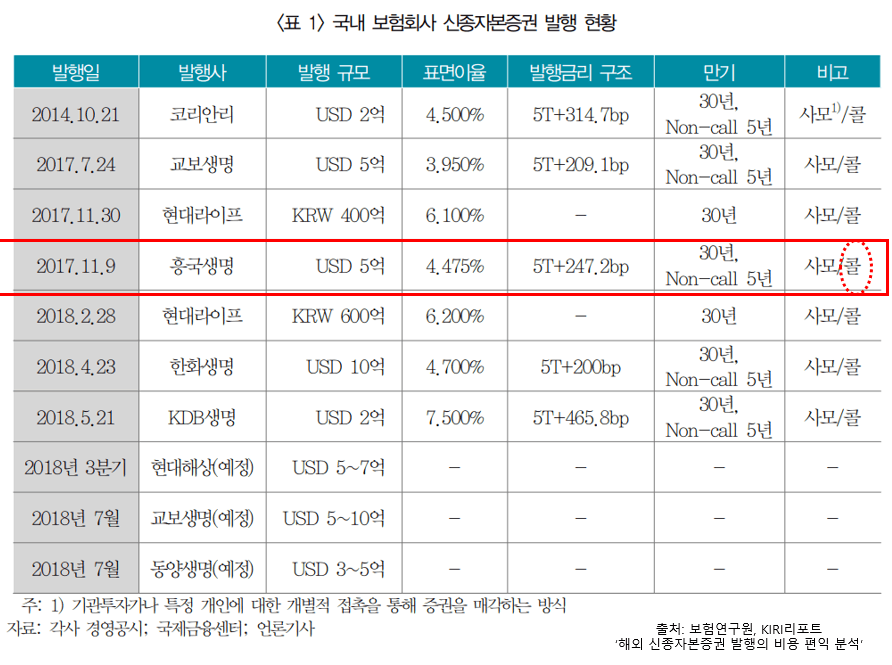

Let's learn about the non-exercise of Heungkuk Life Insurance's new capital securities call options.

Graduated from Kyunghee University, Department of Economics

Worked at Mirae Asset Securities (formerly Daewoo Securities) (2007-2020)

Work locations: Sales Department, Gwanak Branch, Yeongdeungpo Branch, Yeouido Branch

Headquarters Departments: Overseas Products Department, Smart Finance Department, Consulting Center Channel Team

Securities investment advisory staff

Derivatives Investment Recommendation Advisory Staff

Financial Asset Management Specialist

Foreign exchange manager

Fund Investment Consultant

Real estate fund investment consultant

Investment asset management company

Real estate investment asset management company

Who is this course right for?

We explain the impact of the economic policies pursued by the new British cabinet on the bond and foreign exchange markets.

For those who are curious about the impact of inflation on the national bond market and foreign exchange market

For those wondering why the new British Prime Minister and Chancellor of the Exchequer have the shortest tenures in history

For those of you who are wondering what PF is, what ABCP is, and why this happened.

Anyone who needs to understand bond prices and bond interest rates

Anyone curious about how the financial market views this incident?

For those of you who are wondering why the bond market is in chaos due to the Legoland incident

For those of you who are curious about the connection between Legoland and the Duncheon Public Housing Redevelopment Project

For those of you who are curious about what new capital securities are and what call options are, and why this happened.

Anyone who wants to interpret the impact of Heungkuk Life Insurance's call option non-exercise issue in connection with the bond market and foreign exchange market

All

6 lectures ∙ (2hr 31min)

$26.40

Check out other courses by the instructor!

Explore other courses in the same field!