Economic Basics for Investment

financementor

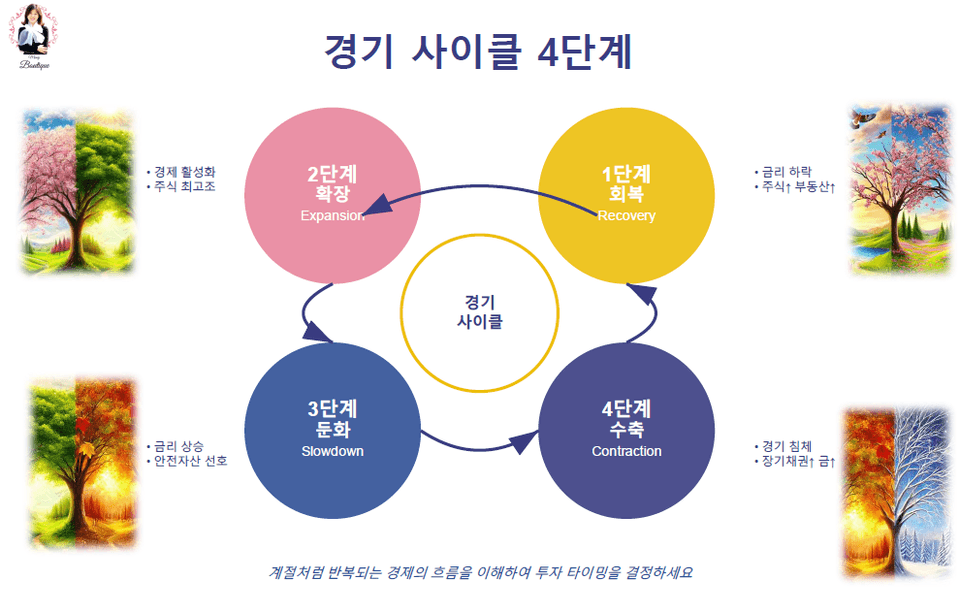

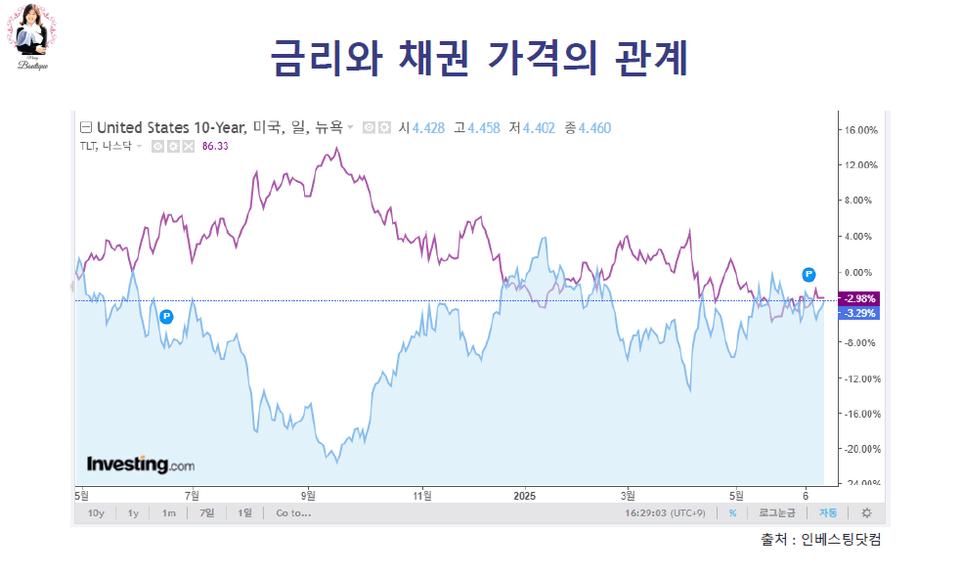

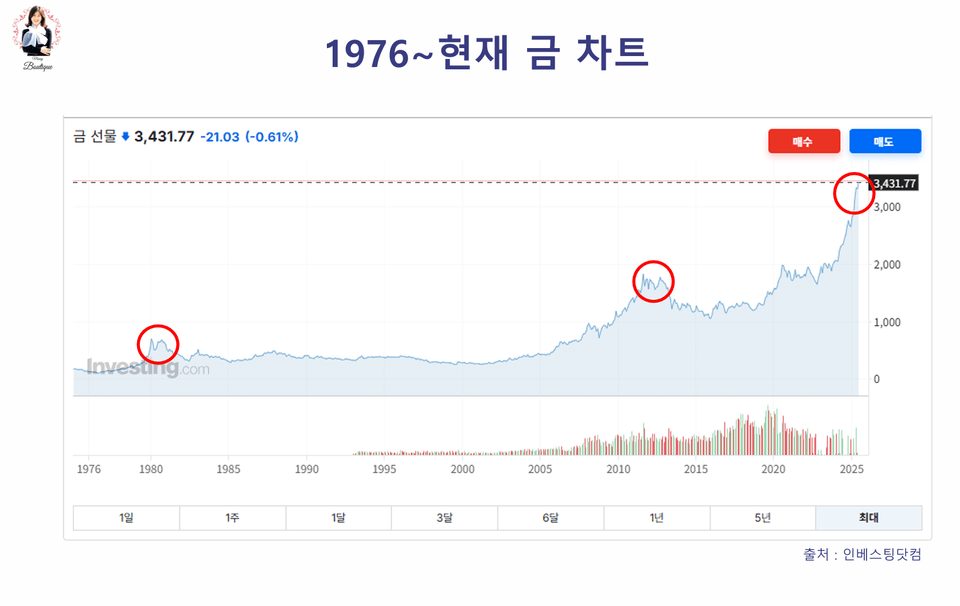

This course is a basic economics course that helps you easily understand the connection between macroeconomics and investment. It allows even beginners to make effective investment decisions based on economic indicators.

초급

Financial Technology, Investment