📣 Note • The video quality of this lecture is not high. Please keep this in mind when taking the class and studying.

Based on more in-depth practical investment

This is a technical analysis & chart analysis course for intermediate traders.

Introduction

Hello, this is TraderCJ , the Hang Seng Prince .

Today, I have prepared some helpful tips for those who are thinking about starting a full-time investment career , as I have been working as a full-time investor for four years, which can be seen as a short or long time .

In my case, I started trading and then immediately began full-time investment activities. At that time , I had no education about investment activities from anyone and just started with the mindset that I wanted to make money through trading . I started trading in an unprepared situation .

Because of that, I have suffered from debt and in some ways, I made this video as a senior to advise people not to waste time and money like me learning simple principles and rules that anyone can think of .

However , the few pieces of advice and principles I will start with from now on are purely my subjective thoughts and mindset , so they cannot be absolutely correct .

Responsibility for investing lies with each individual . Let's first remind ourselves of this and move on.

Conditions for full-time investment

1. You have reached a point where you can read the market trends by analyzing charts yourself , and you should be able to make profits through trading on your own without receiving guidance .

2. Trading is also a personal business . Be prepared .

3. Investing without a profit target and loss limit is like gambling . Set limits .

4. I never owe anything to anyone .

5. You have to be humble and work hard .

A full-time investor's daily life

1. Start of work

When working as an investor, your typical workday should start before 9:00 AM .

A clear mind after waking up, washing up , and eating is helpful for investing .

Simply put, this is the same situation as driving while your mind is hazy and half-asleep .

Just as drowsy driving can lead to serious accidents, you should remember that starting a trade without a clear mind can lead to significant losses due to poor thinking .

2. Organize your trading plan for the day and set up your trading setup.

There is a clear difference in profit between trading after determining the main sections and response plans in a prepared situation and opening a chart and starting to trade without preparation .

We need to bet on the direction of the day's trend before the market opens with a clear mind , and we need to select the main entry points, which can be seen as pulse points, and identify good entry points .

Or, if a different trend emerges from the range I analyzed, I need to make a plan for trading in which direction to proceed and then trade .

3. Reduce risk , increase reward .

Chinese players tend to increase their bets significantly when things are going well , and gradually reduce them when losses continue . Koreans, on the other hand, increase their bets when things are going poorly, and then reduce them to protect their profits .

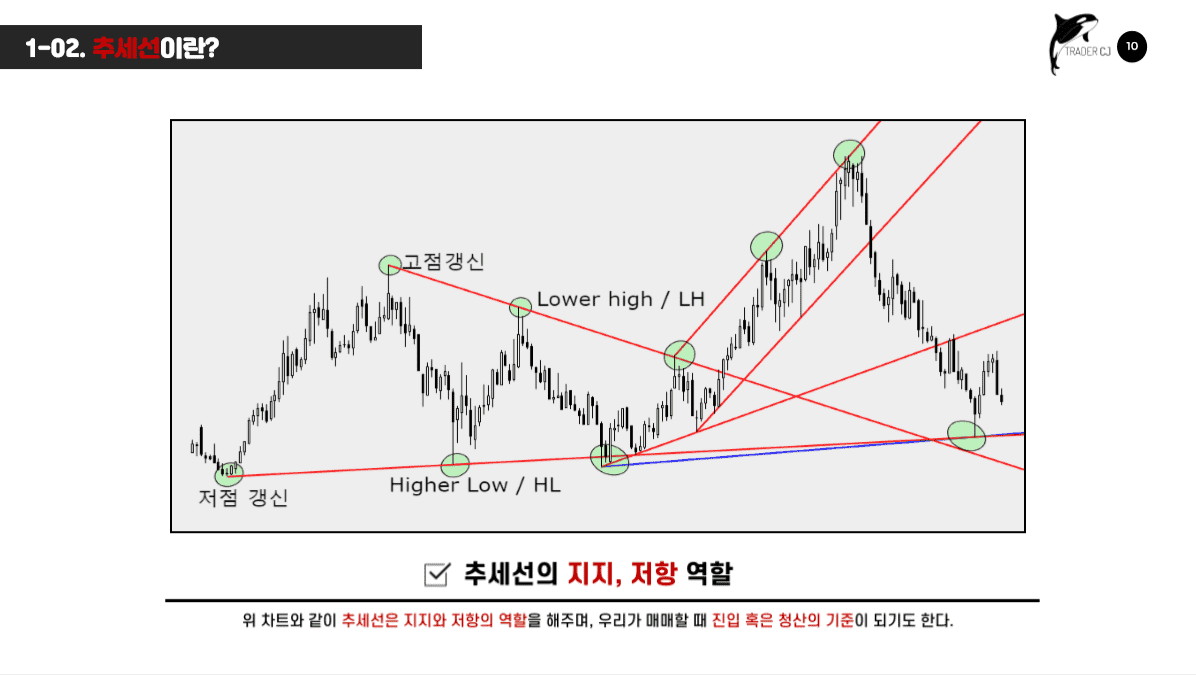

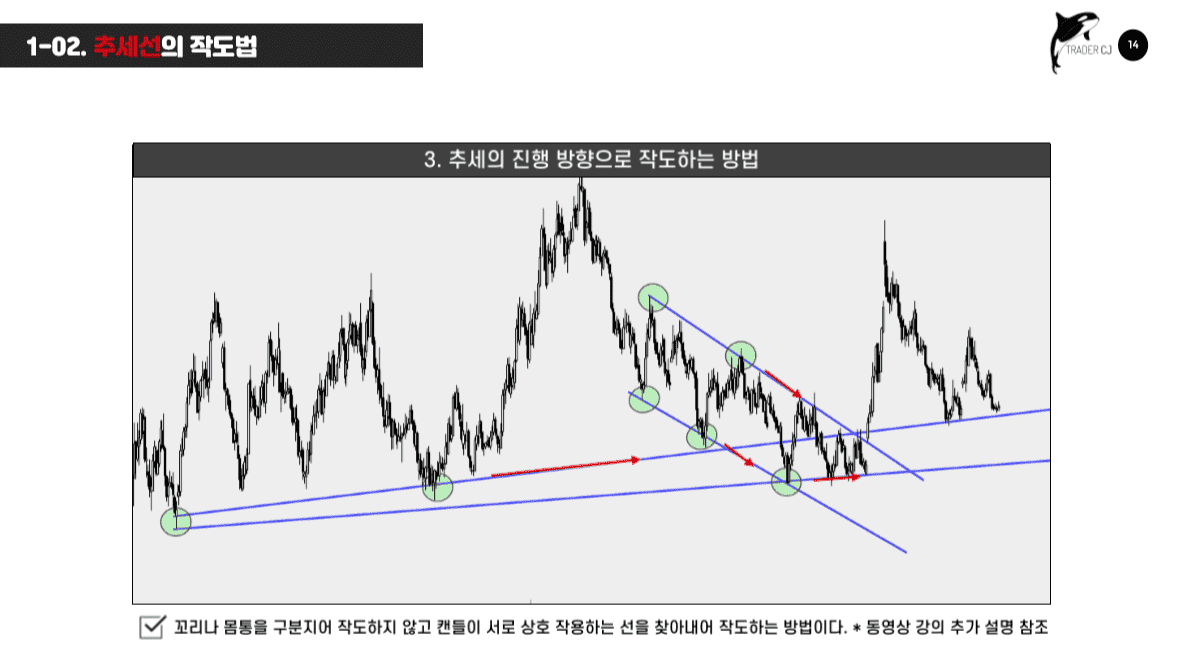

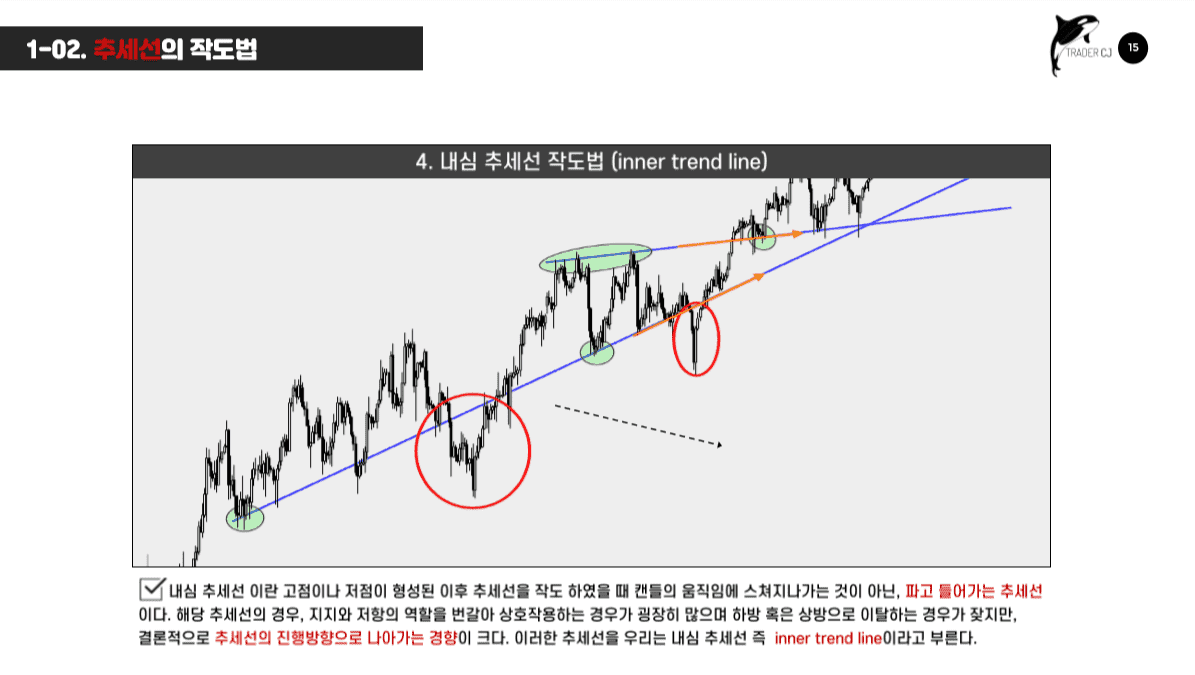

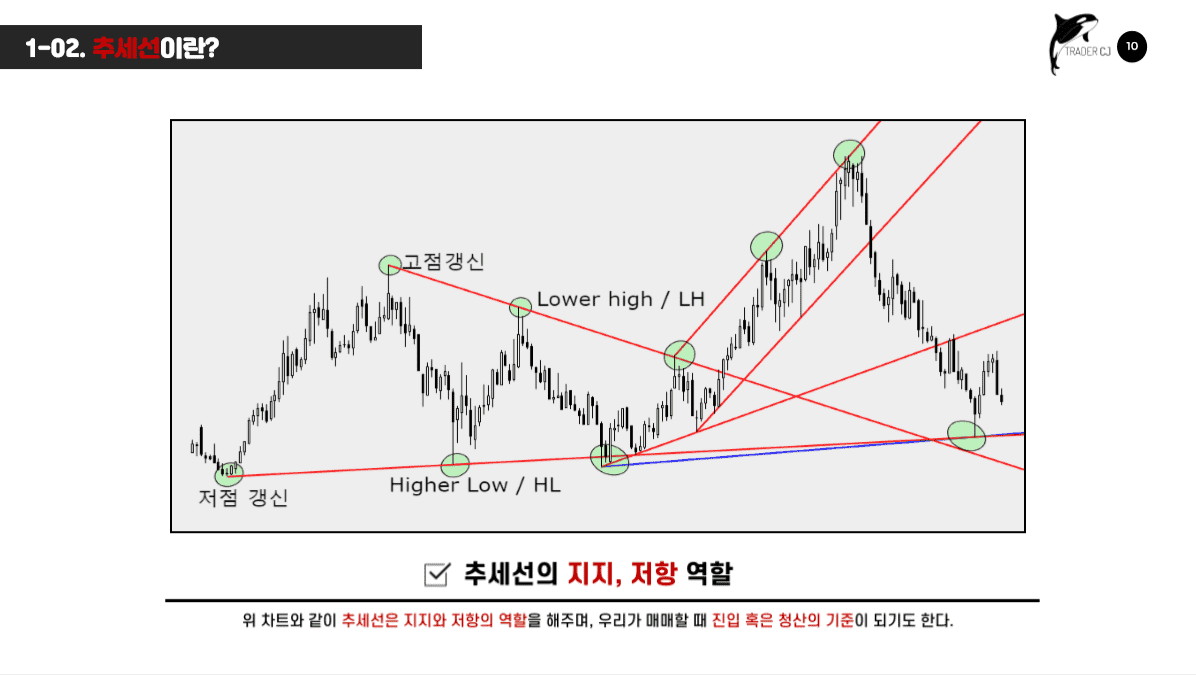

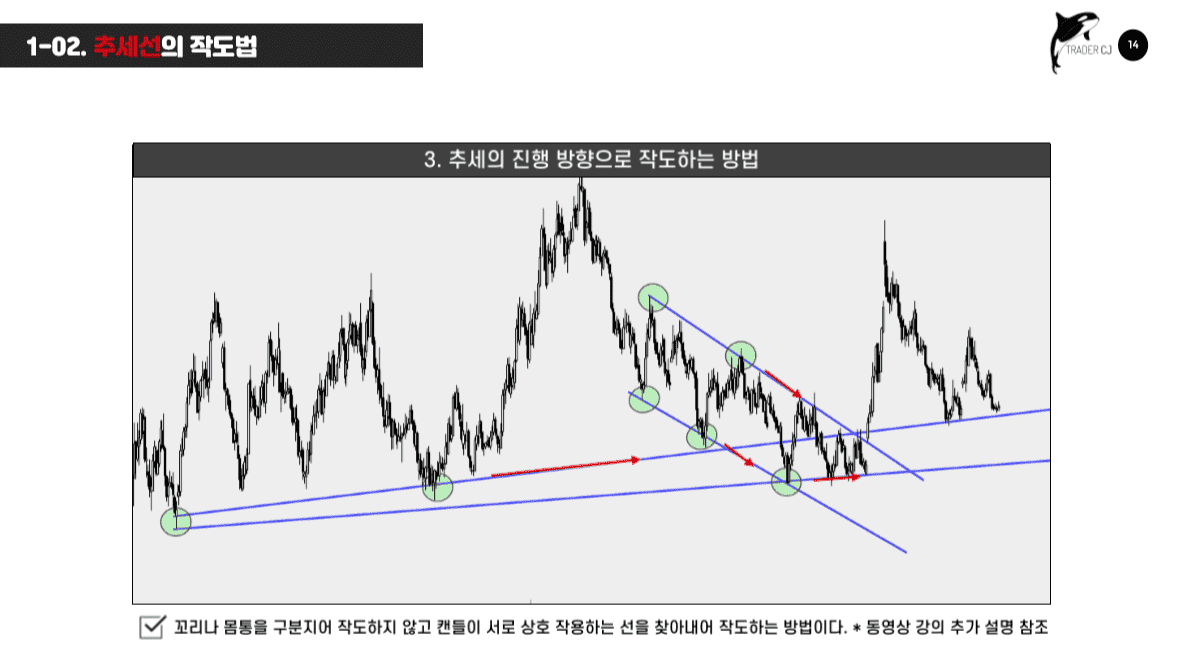

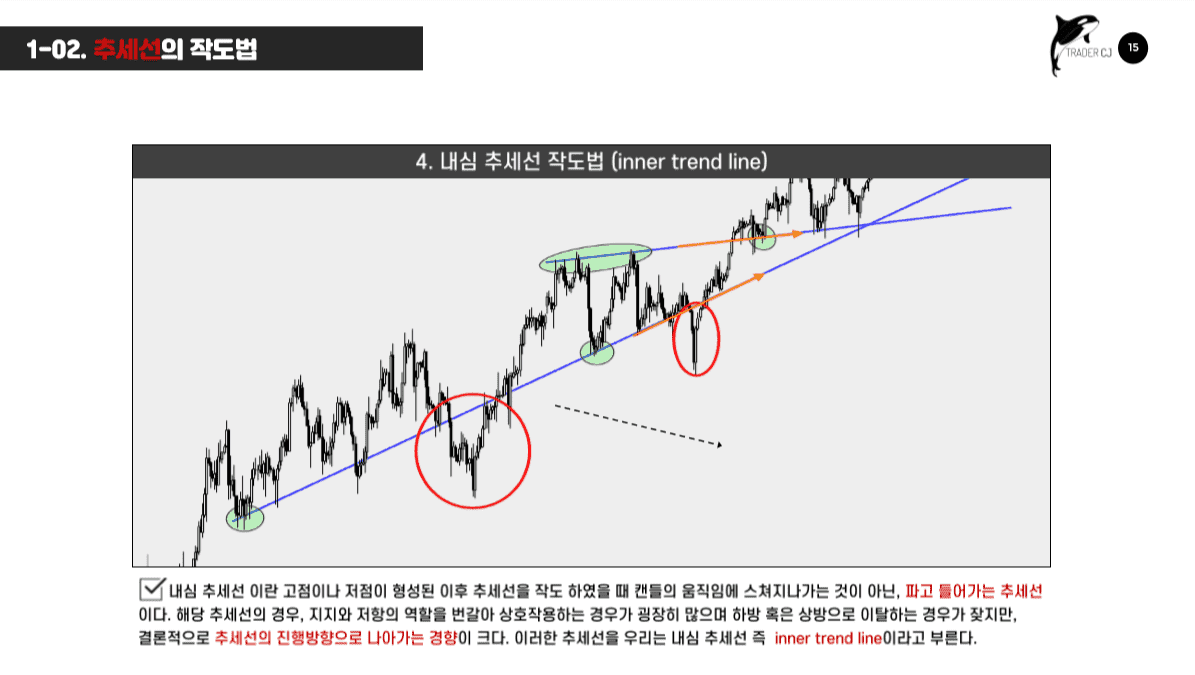

Lecture Content Preview Lesson 1 Trend Lines

![[Basic Tax Guide] for Freelancers and YouTubers강의 썸네일](https://cdn.inflearn.com/public/courses/324857/course_cover/784e8eb0-e3a4-48c2-8583-c2a93d28c703/djm-tax.jpg?w=420)