主要指標分析によるビットコイン、アルトコイン投資ノウハウ

dannyworld

ビットコインとアルトコインへの投資時に見逃すべきではない安全な指標と客観的なデータを見る方法、 0ウォンから1億ウォンまでの実際のエアドロップノウハウと実戦方法を共有

입문

Blockchain, Financial Engineering, Financial Technology

Learn about the basics and essential knowledge of financial products in the financial sector (banking/securities/insurance). Based on this, you will learn the know-how to apply to actual investments, and also learn about the unknown culture and reality within the financial sector.

Basic and essential knowledge about financial products in the financial sector (banks/securities/insurance)

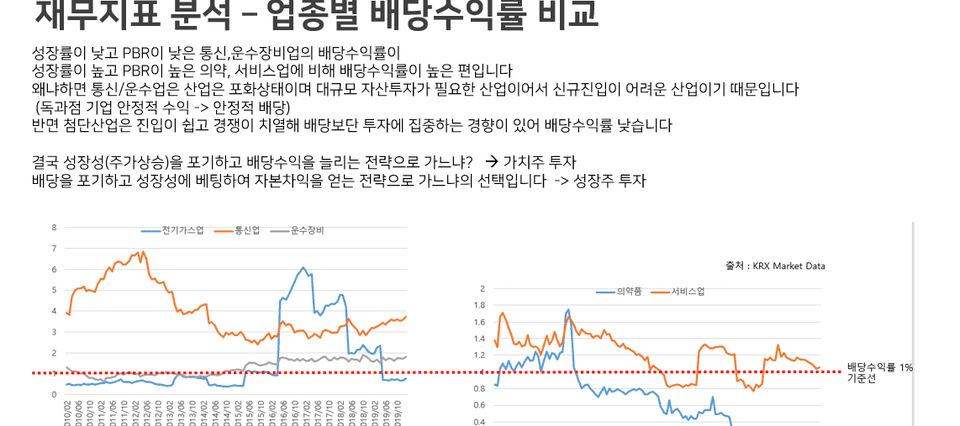

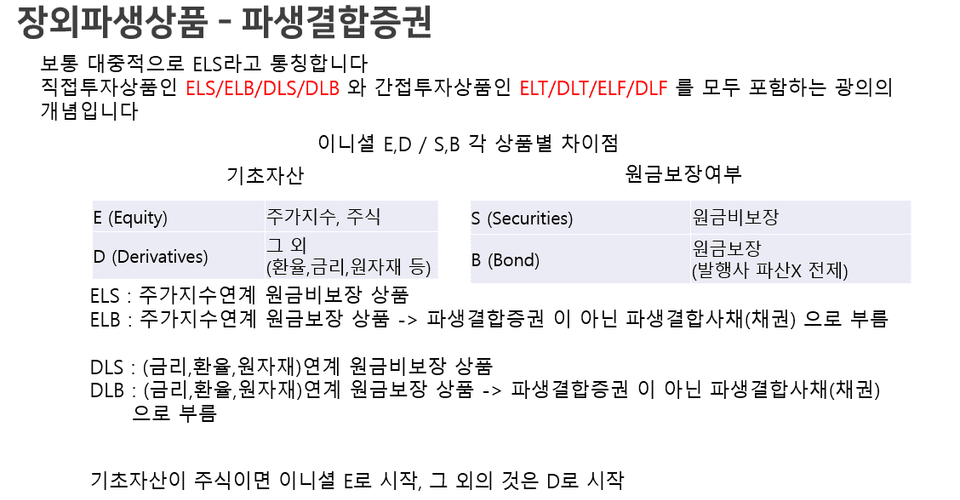

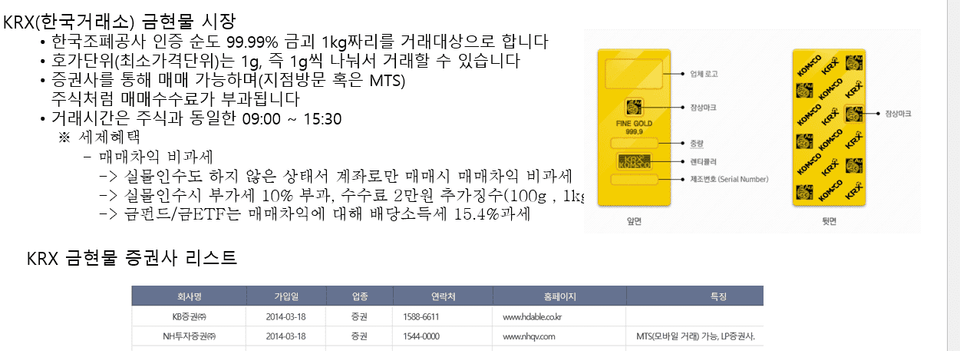

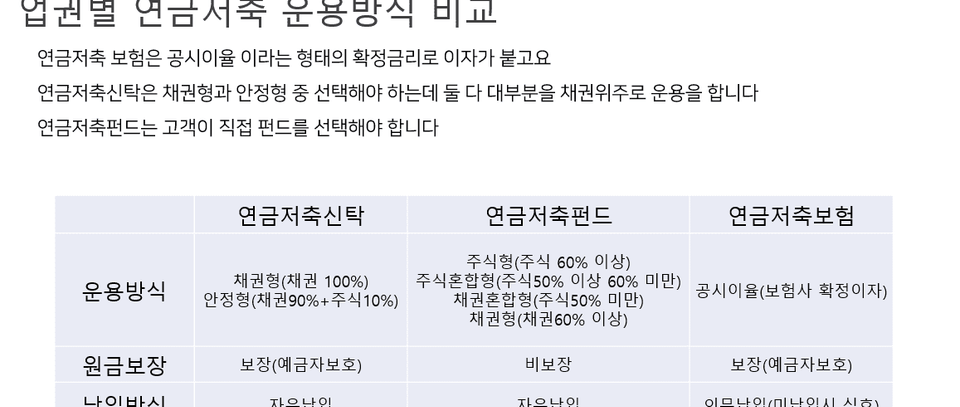

Analysis of the structure and profit generation principles of financial products and past rate of return

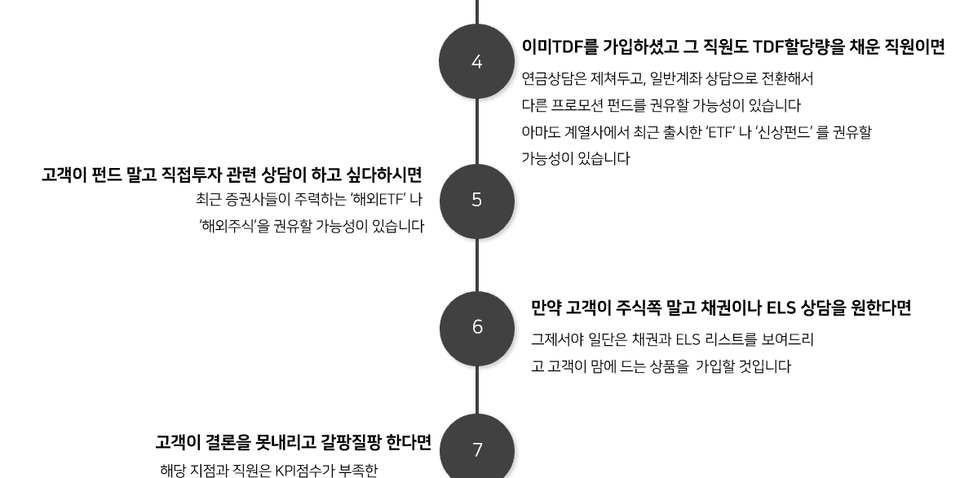

Analysis of the interests of financial institutions, employees, and customers

Financial knowledge that can be damaging if you are not aware of it or do not know it

Understand the need for asset management throughout life

Are you interested in investing and asset management?

Well then, let's start properly! 🔥

I'll explain the practical issues and questions you'll encounter when starting your financial investment/asset management journey: "This is the cause, this is the process, and this is the result so far."

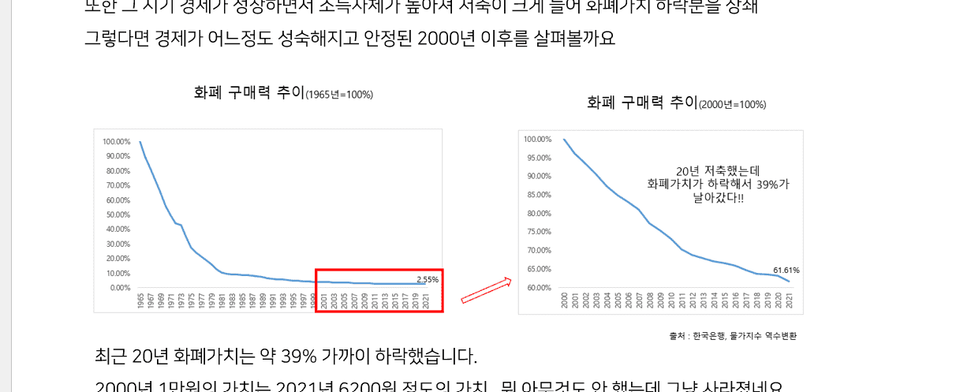

In this age of sudden poverty, the value of your hard-earned savings is eroding. With inflation expected to worsen, many people seem to feel a sense of crisis, compelled to take action. Many are also suffering the devastating consequences of ignorant investments.

For these individuals, we've created a course that explains popular financial products (banking, securities, and insurance) and helps them apply them to real-world situations. In this course, you'll learn essential financial product knowledge for asset management .

Special features of this course ✨

For those who know nothing about finance but want to learn the basics

People who don't know where to start studying even after reading books or watching YouTube

Those who want to expand their investment area or diversify their portfolio

For those wondering how much to trust what financial planners/asset managers say

After attending the lecture, you! 🪄

1) Investment motivation and long-term inflation

Consider the global phenomenon of long-term inflation and the transition from an era of savings to an era of investment.

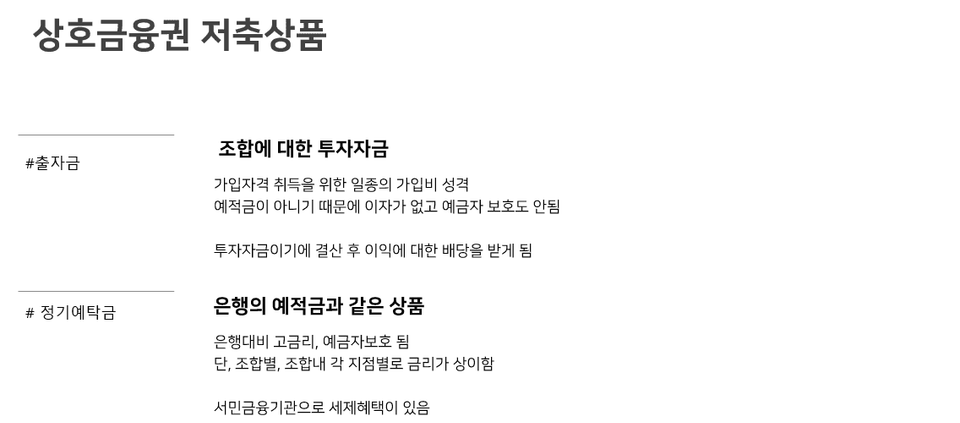

2) Savings products

Learn about savings products from banks and other financial institutions.

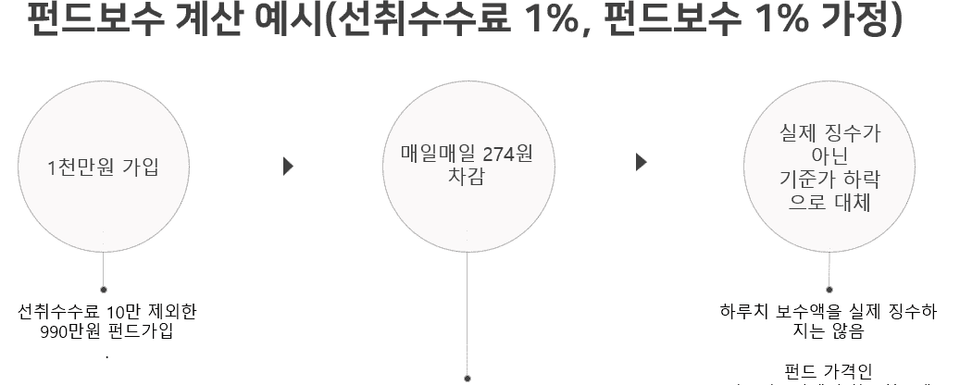

3) Financial investment products

Learn about financial investment products

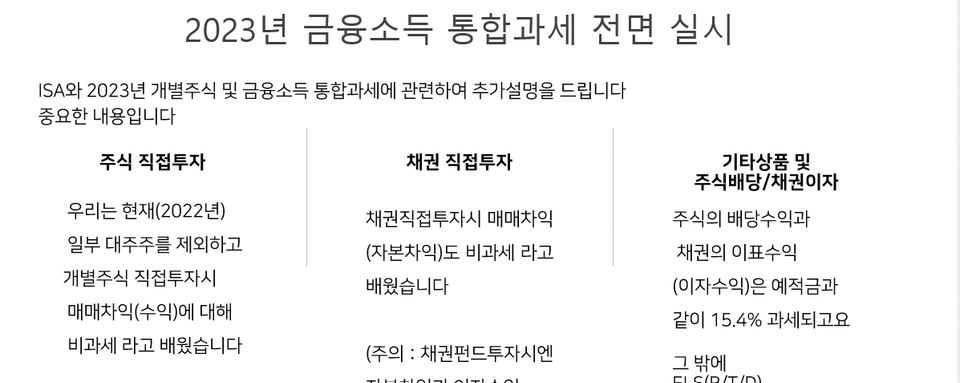

4) Tax-saving products

Learn about products (accounts) with tax benefits.

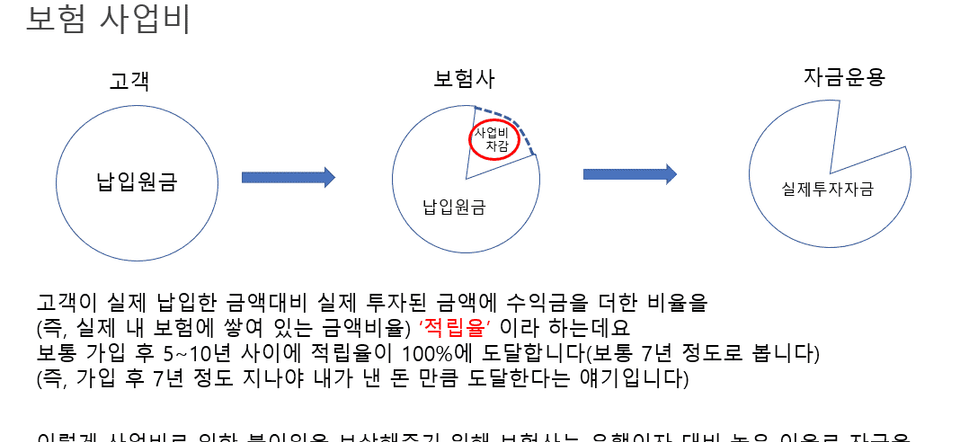

6) Insurance and financial management

Learn about savings insurance with investment features.

7) Financial institutions and their employees

Learn about the organizational culture and business practices of financial institutions.

Please note before registering for classes 📢

This course is a video lecture with the same content as the text lecture above. Please note this before registering.

Q. Is it possible to disclose the rate of return of the knowledge sharer?

We apologize. This information will not be disclosed. This book was written to provide basic financial investment knowledge. Please note that it is not a book on asset allocation or management.

Q. Do you have any strategies for increasing returns or saving taxes?

To maximize returns, it's helpful to understand the economic climate, product structure, and profit-generating principles. This book also includes information on changes to the tax system in 2023 and countermeasures.

Q. Is there any information on trading timing, chart analysis, etc.?

This content has been excluded due to potential misunderstanding. However, understanding the basic indicators related to interest rates and stock prices in the "Direct Investment (Stocks, Bonds)" section will be helpful in determining timing and appropriate stock prices.

Career history

Qualifications

Who is this course right for?

People who have no knowledge of financial technology

Ignorant investor

Anyone who has been hurt by being deceived by a financial institution or employee

For those who want to invest with proper knowledge

Anyone who wants to learn about investment finance from someone with experience or qualifications

Need to know before starting?

If you can read Korean, hear, see, and do basic arithmetic, you will have no problem understanding it.

All

15 lectures ∙ (10hr 4min)

All

3 reviews

5.0

3 reviews

Reviews 1

∙

Average Rating 5.0

Reviews 3

∙

Average Rating 5.0

5

よく聞きました。 特定の資産管理技術を聞くには当てはまらず、本格的な資産管理を始める前に、全体的な商品の種類、金融市場の理解に本当に大きな助けになります。

ありがとう 今後もより良い講義でお会いしましょう。

Reviews 1

∙

Average Rating 5.0

Explore other courses in the same field!