Real Q&A? What are you curious about in the business plan!

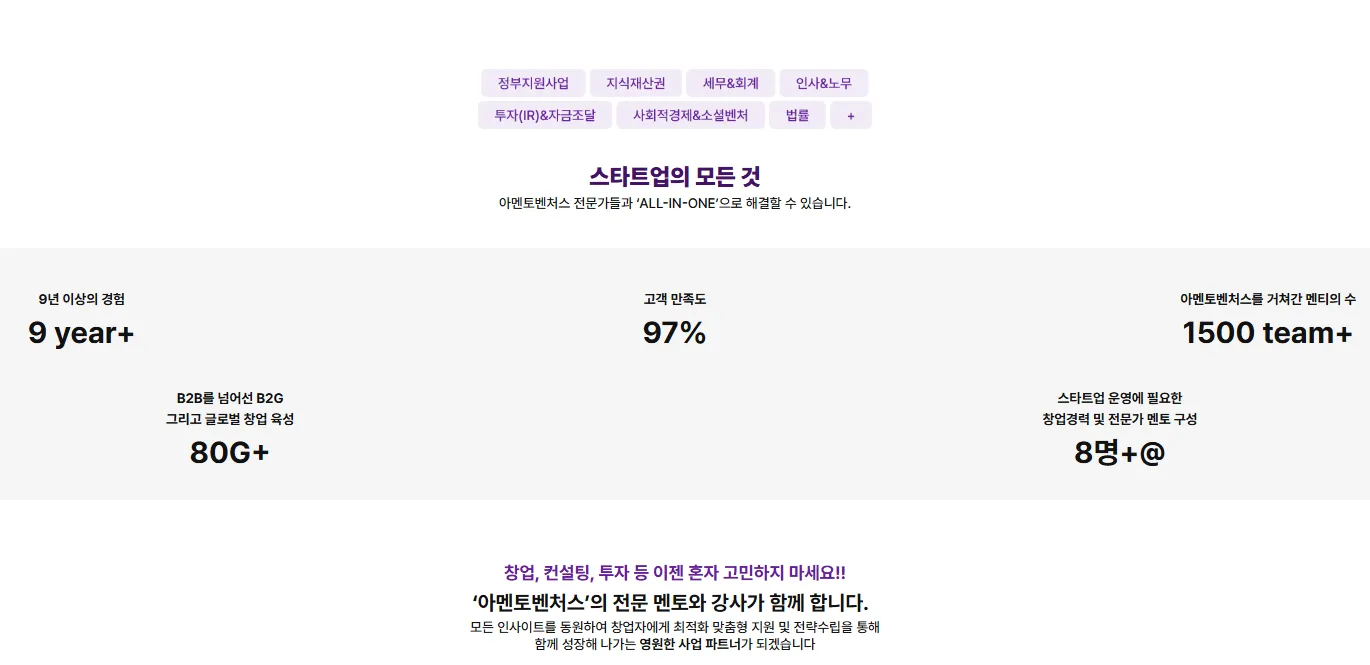

amentoventures

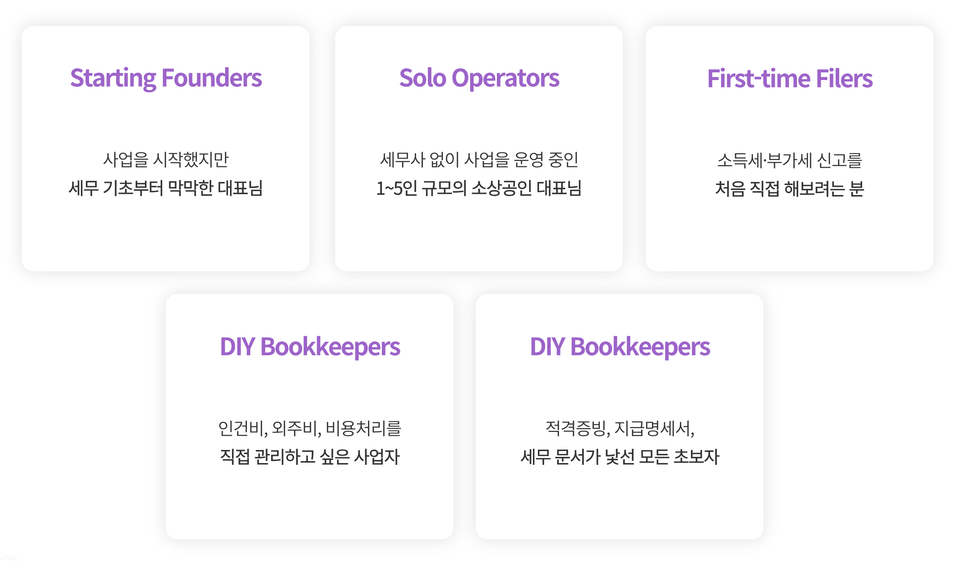

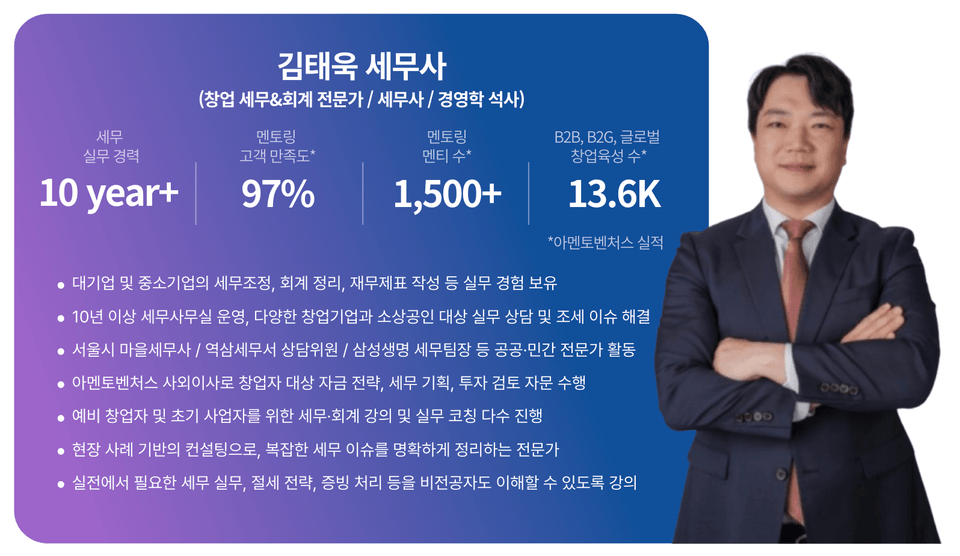

We have gathered only the questions that actual prospective founders and startup representatives are most curious about. A real Q&A lecture answering from the judges' perspective. Now, don't worry about it alone anymore.

초급

Business Plan