Investment Guide for Monthly Dividend ETFs for Freedom!

financementor

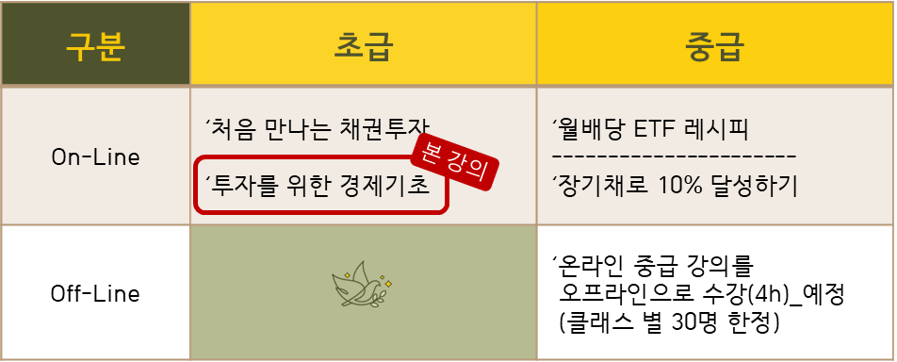

This course starts very easily from ETF basics, stock&bond&gold basics, and economic basics, covering everything from the fundamental concepts of monthly dividend ETFs to advanced strategies and real-world market application. Investing without prior learning is like crossing a bridge precariously while blindfolded. Please be sure to learn beforehand before investing.

Beginner

Financial Technology, Investment