![[Sales Management Archive] Accounting & Tax Essentials for Sales Operations강의 썸네일](https://cdn.inflearn.com/public/files/courses/339308/cover/01k806s2vw8p0e55pws0yy5d5x?w=420)

[Sales Management Archive] Accounting & Tax Essentials for Sales Operations

kpcre

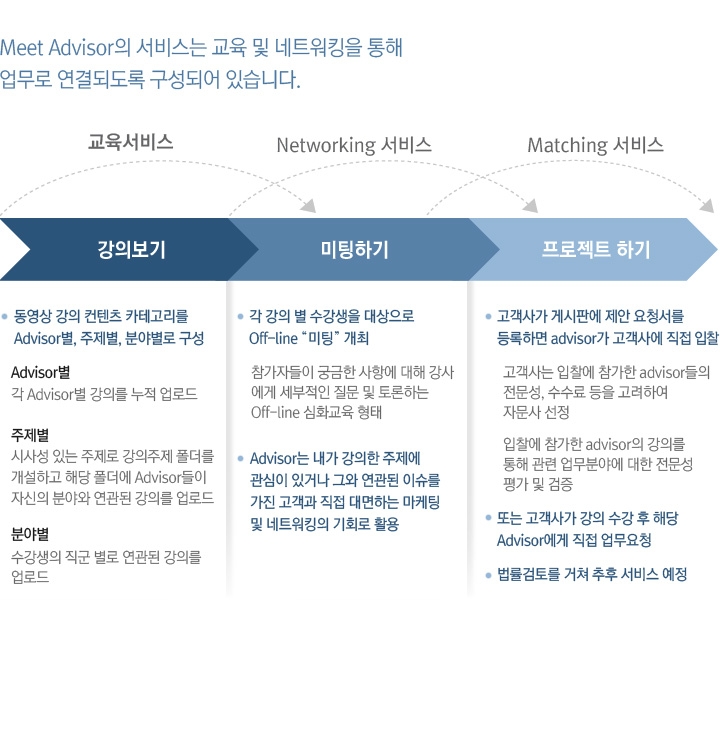

This course provides an opportunity to analyze the types and utilization methods of financial statements, and to examine key financial information included in financial statements to analyze indicators that can help determine opportunities and risks. Additionally, through CVP (Cost-Volume-Profit) analysis, you will derive break-even points and target sales amounts, and practice financial decision-making cases such as whether to accept special orders. Finally, we will cover the overall framework and terminology of value-added tax, as well as the procedures for preparing and issuing tax invoices.

입문

Taxation Business, sales