Multicore is a programmer and AI expert. He has been active in various fields as a programmer and currently works at a company improving business environments using data analysis and reinforcement learning. He strives to show his juniors that AI is not a field reserved only for a few experts with advanced degrees, but an area that programmers can also successfully challenge. He is the author of "Reinforcement Learning for Programmers."

Reinforcement Learning Through Code, Like a Developer (2025) / Freelec

A Study on Improving Deepfake Image Classification through Deepfake Model Analysis (2024) / Korea Institute of Convergence Security (KICS)

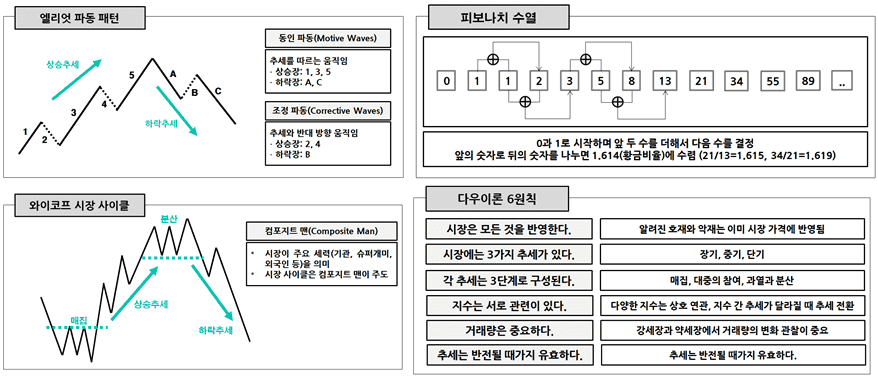

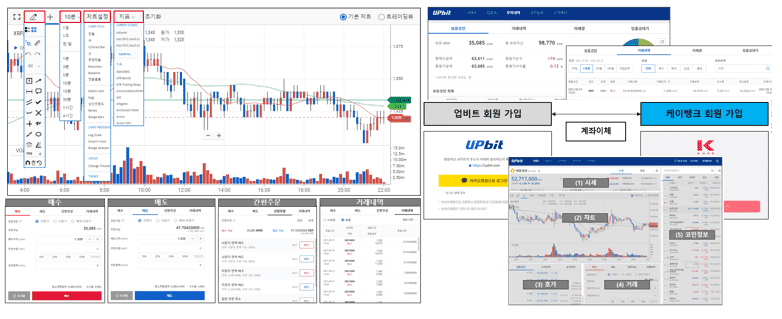

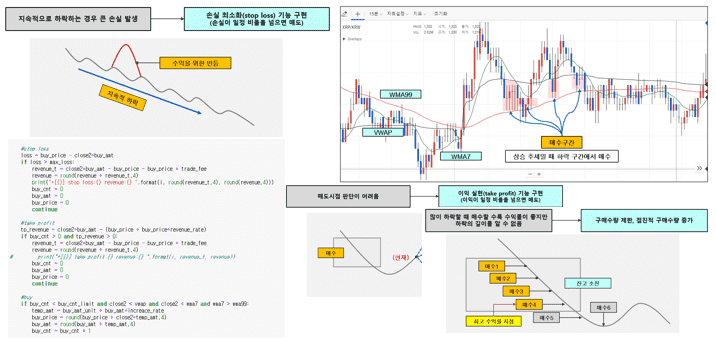

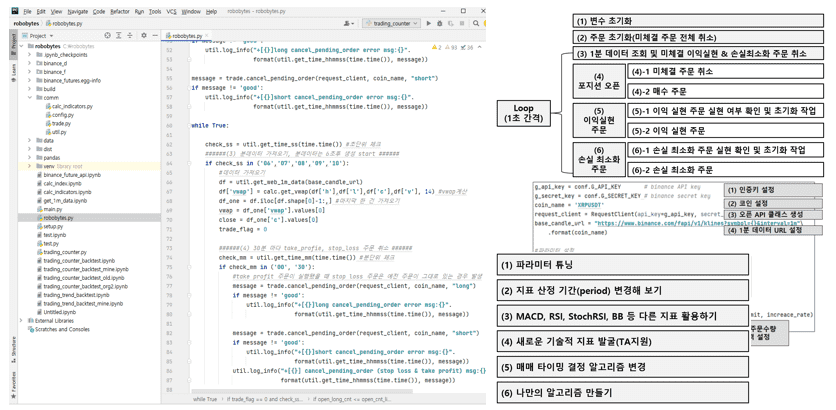

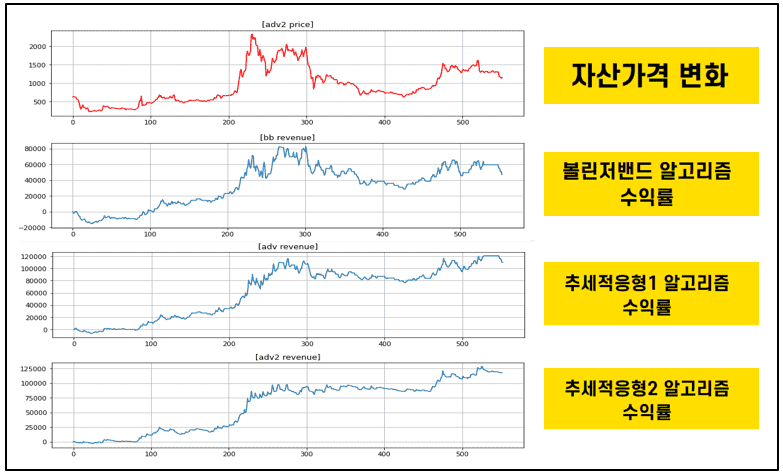

Writing a Bitcoin Futures Automated Trading System (2022) / Freelec

Reinforcement Learning for Programmers (2021) / Freelec

Research on Browser Fuzzing Techniques Using Multiple DOM Trees (2017) / Yonsei University

Obtained Information System Principal Auditor Certification (2015) / Korea Information System Audit Association

Professional Engineer Computer System Application (2013) / Human Resources Development Service of Korea