Survival Strategy for Staying Alive, WEB3

coincraft

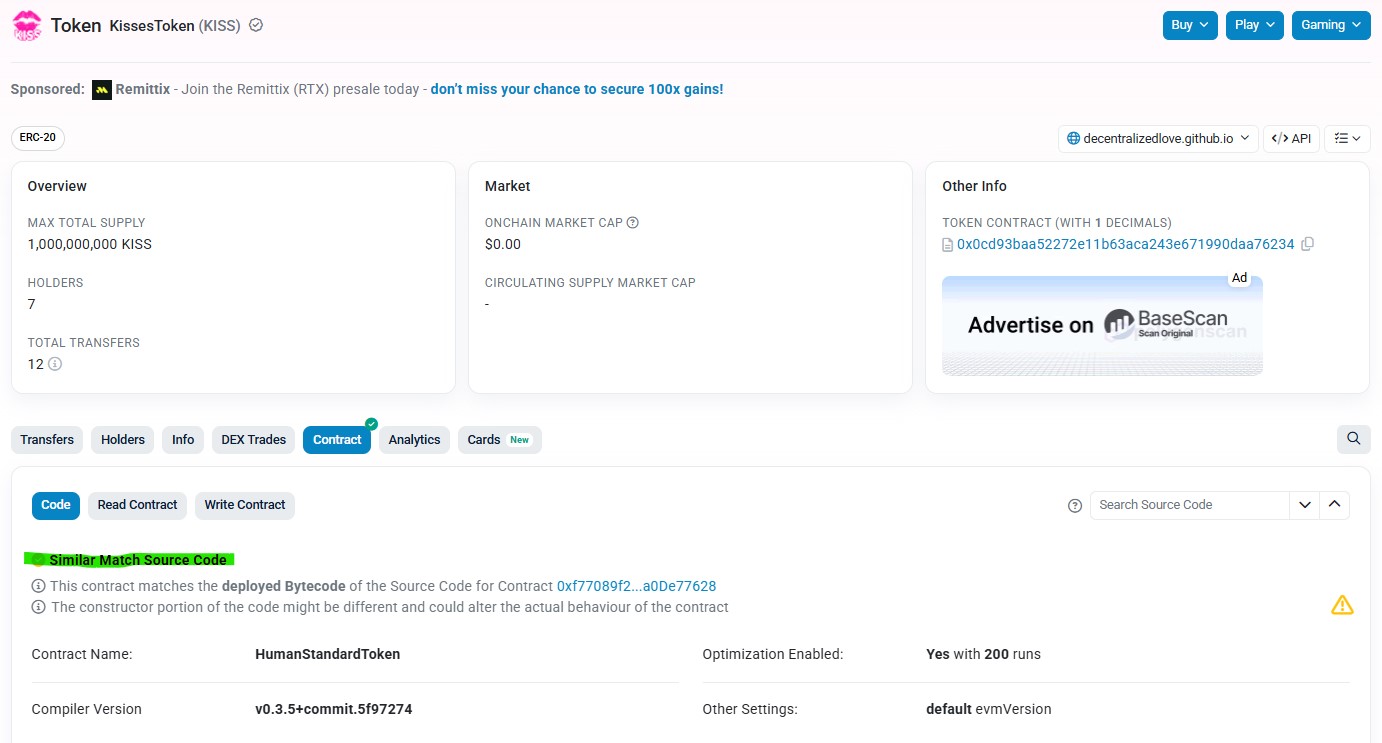

This course is a complete beginner's introduction prepared for those new to Web3. It explains in an easy and intuitive way why blockchain is important, how wallets, addresses, and transactions work, and the concepts we must know in the Web3 era. Through this course, students will: Understand the Web1 → Web2 → Web3 evolution Learn the core structure of blockchain (wallets, addresses, keys, transactions) Grasp the meaning of decentralization and the changes Web3 will bring Practice basics like creating and sending with actual wallets Naturally acquire these skills and establish a first foothold into the Web3 world. Designed to be accessible even without a technical background, this course is structured around easy and practical examples by an active on-chain analyst. If Web3 felt unfamiliar and difficult, experience the most friendly first step in this course.

입문

DApp, Blockchain, Digital Literacy

![[A hundred words are not as good as seeing once] Advanced SQL for data analysis강의 썸네일](https://cdn.inflearn.com/public/courses/324605/cover/141a32ce-69fe-42d9-9253-d2136e208464/sql_advanced.png?w=420)

![[Management Course #3] DE, DBA (SSIS, SSAS, MachineLearning, BI, ETL)강의 썸네일](https://cdn.inflearn.com/public/courses/329784/cover/c5e6543b-72c3-4471-b43f-15b9002e65ed/329784-eng.png?w=420)

![Data Analyst, Which Company Should I Go to? [Datarian Seminar Replay | July 2024]강의 썸네일](https://cdn.inflearn.com/public/courses/334459/cover/22684393-748c-43e3-8282-fcd6fee701d9/334459.png?w=420)