입문자를 위한 주가와 재무제표를 활용한 기업분석지표 이해

한국CFO스쿨

₩110,000

입문 / 재무, 회계

5.0

(3)

일반인 입문자를 위해 주가와 재무제표를 활용한 기업 분석/평가, 사업과 재무제표의 연결, 기업가치의 이해에 대해 관심 있는 누구나 비교적 짧은 시간에 쉽고 충실하게 익히고 활용할 수 있는 기본 강좌입니다.

입문

재무, 회계

강의 추천하고 성장과 수익을 만들어 보세요!

마케팅 파트너스

강의 추천하고 성장과 수익을 만들어 보세요!

먼저 경험한 수강생들의 후기

5.0

Pika chu

세금에 대한 두려움을 없애준 강의! 막상 뭐부터 알아야 할지 몰랐는데 하나하나 쉽게 설명해주십니다. 평소 알고 싶었던 내용도 많았고 특히 중간에 나오는 그림들이 귀여워요 ㅋㅋ 덕분에 더 쉽게 이해되었답니다. 부담 없이 세금에 대해 알고 싶어서 무턱대고 듣기 시작했는데 돈 버는 사람이라면 한 번쯤 고민해본 것에 대해 잘 알려주셨어요. (저는 유튜버는 아니지만 유튜버 부분이 진짜 재미있었어욬ㅋㅋㅋㅋ) 선생님~ 덕분에 세금에 대해 용기가 생겼어요! 감사합니다!!

5.0

교양있는개발자

세금 기초에 관한 명료한 강의입니다. 지루하지 않게 잘 설명해주셔서 짧은 시간에 많이 배웠습니다. 지금은 신고할 사업 소득이 없지만, 나중에 세무 관련 업무가 필요할 때 요긴하게 쓰겠습니다. 책도 마음에 듭니다. 감사합니다.

5.0

Jang Daehyuk

[프리랜서를 꿈꾼다면 꼭 들어야할 강의] 개발이나 디자인 공부를 하는 사람이라면 프리랜서에 대한 생각을 한 번 쯤 해보게 됩니다. 그 때를 생각해서라도 들어볼 가치가 충분한 강의입니다. 또, 프리랜서를 중점적으로 세금에 대한 가이드를 알려주지만 회사에서 일을 하는 근로자도 알야아 하는 부분들이 꽤 나옵니다. 기초적인 개념들이라서 굳이 프리랜서가 아닌데 도움이 될까? 라고 걱정 안해도 될 것 같습니다. 저 역시 이제 막 사회생활을 한 사회초년생이지만 저에게도 필요한 개념들이 많았습니다. 또한, 강의의 진행방식(애니메이션 같은 그림)이 이해가 잘되서 좋았습니다. 세금에 대해 전무했지만 기초를 조금 다질 수 있는 계기가 되었습니다. 프리랜서가 아닌 근로자에게 초점을 맞춰서도 세금 강의가 있었으면 싶었습니다. 짧은 시간이었지만 유익한 강의 정말 감사합니다 :)

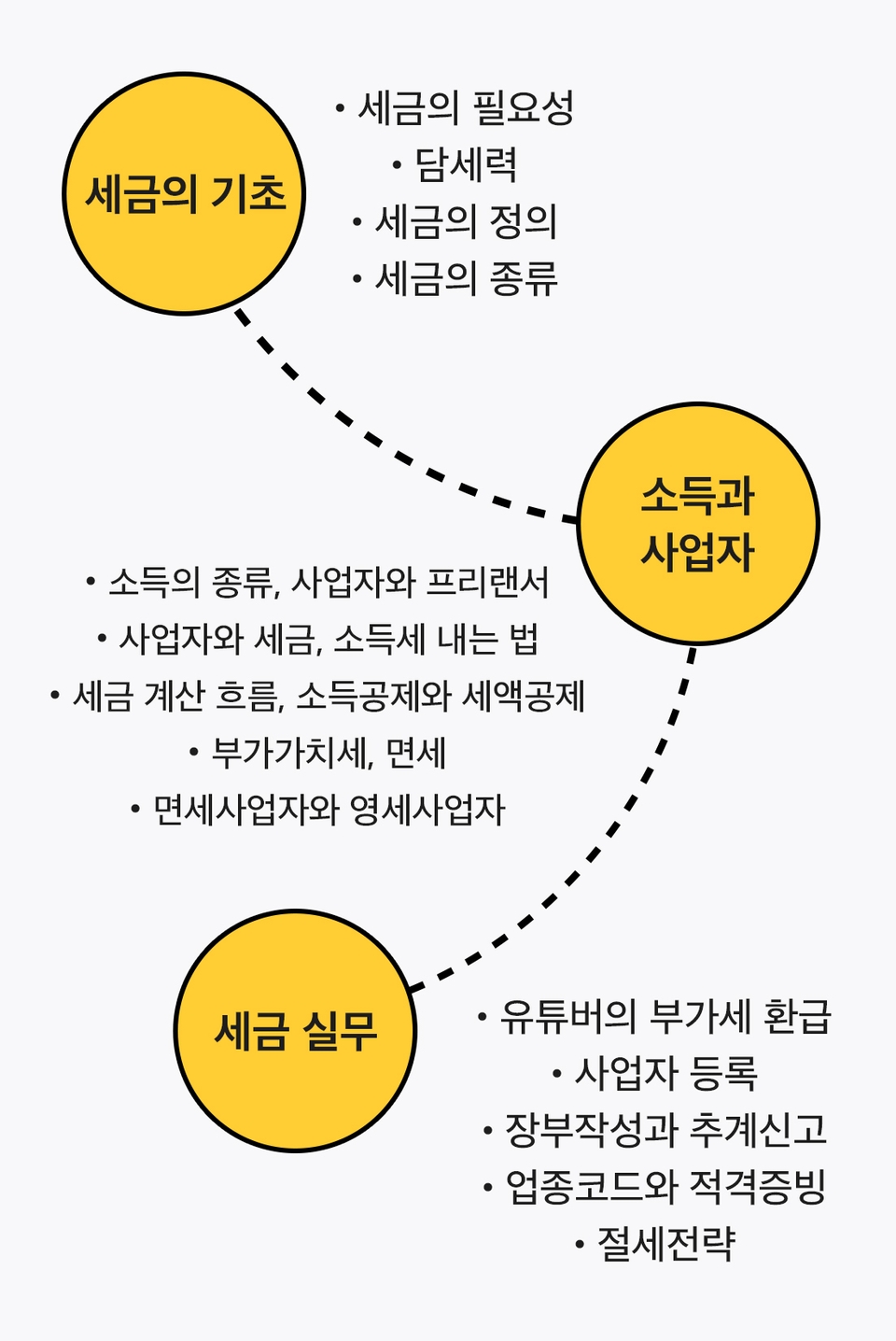

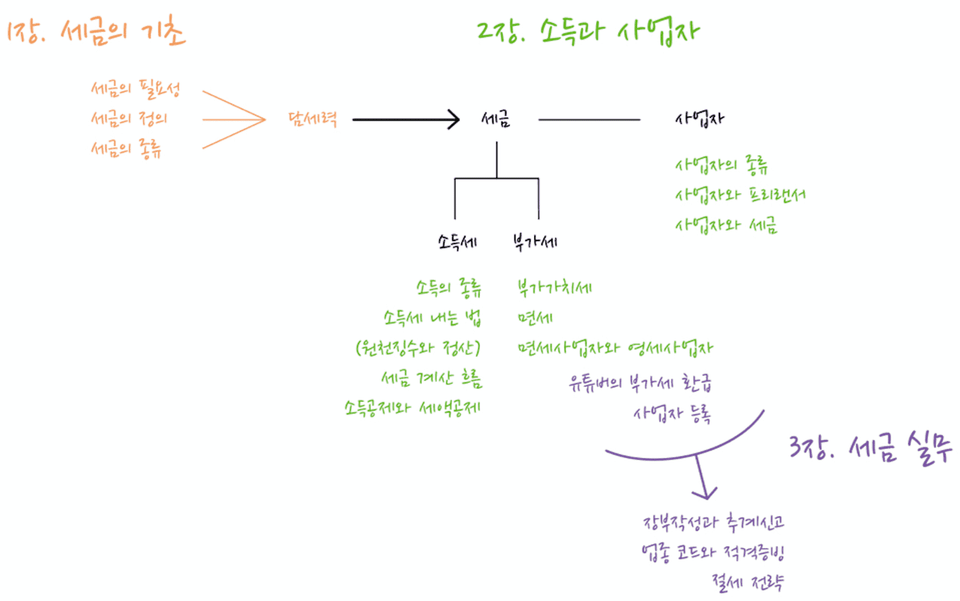

기초 세금 지식

프리랜서와 사업자 등록

종합소득세 - 원천징수부터 연말정산까지

유튜버와 부가가치세 환급

절세 전략

▼ 수강 전, 리뷰를 확인해보세요.

👉장대혁님의 수강후기 : 이제 막 사회생활을 한 사회초년생이지만 필요한 개념이 많았습니다. 짧은 시간이었지만 유익한 강의였어요 :) [리뷰 더보기]

👉이현수님의 수강후기 : 무엇보다 짧아서 좋고(1시간), 짧고 굵은 설명으로 세금에 관해 많이 배울 수 있었어요. 세금에 관해 생소한 분들에게 추천드립니다. [리뷰 더보기]

▼듀자미 기초 세금가이드

주체적인 경제생활을 이루기 위해서는 세금에 대한 지식이 반드시 필요합니다. 하지만 우리 주위에서는 이토록 중요한 세금에 대해 자세하게 알려주는 곳을 찾기 어렵죠.

본 콘텐츠를 통해 유튜버와 프리랜서 혹은 사업자뿐만 아니라 우리 모두가 알아야 할 세금에 대해 알아봅시다!

세금이란 주제는 다소 어려울 수 있지만 살아가면서 반드시 알아야 하기에, 조금 더 쉽게 체계를 잡고 이를 실천할 수 있도록 기초적인 내용을 다루었습니다. :)

또한, 시각자료를 충분히 활용하여 내용이 효과적으로 전달될 수 있도록 구성하였고, 짧은 시간 동안 핵심을 다루어 집중력을 최대로 끌어올릴 수 있도록 기획하였습니다.

• 올해부터 돈을 벌기 시작하였는데 어떤 세금을 내야 하나요?

• 유튜버가 받은 후원에도 세금이 매겨지나요?

• 연말 정산과 종합소득세 신고는 어떤 차이가 있나요?

• 프리랜서인데 부가세 신고를 해야 하나요?

• 세금은 어떻게 계산되나요?

이 외에도 세금을 절약하는 방법과 세금을 납부하는 방법 등 실생활에서 바로 적용할 수 있는 내용을 다루었습니다!

• 이 분야에 관심을 가지게 된 계기가 무엇인가요?

: 저희도 처음 프리랜서로서 일을 시작했을 때에는 세금에 대해 모르는 것이 많았습니다. 그래서 눈앞의 당면한 문제들을 해결하기 위해 하나둘씩 공부하였고, 주변 세무사 분과 국세청의 도움을 얻기도 하였습니다.

이윽고 어느 정도 세금에 대해 감이 잡힐 때 즈음, 저희뿐만 아니라 많은 분들께서 세금과 관련하여 도움을 필요로 하신다는 사실을 깨달아 이처럼 세금을 주제로 프로젝트를 진행하였습니다. 본 콘텐츠를 통해 그동안 궁금해하셨던 부분이 속 시원하게 해결되기를 희망합니다.

• 이 강의만의 특별한 장점이 있을까요?

: 직접 부딪히며 얻은 지식이기에 조금 더 생생하게 전달될 수 있고, 저희 또한 충분히 헤맸던 경험이 있어서 핵심 포인트를 잘 짚을 수 있다고 생각합니다.

• 앞으로 듀자미 스튜디오가 이루고 싶은 목표는 무엇인가요?

: 정보 디자인을 통해 더 많은 분께 효율적으로 정보를 전달하여 교육 기회의 평등을 이루고 싶습니다.

<듀자미 스튜디오의 목표>

강의를 보시고, 후기를 남겨주시면

선정을 통해 <프리랜서 세금 가이드>를 보내드립니다!

학습 대상은

누구일까요?

세금의 대략적인 구조를 쉽게 접하고 싶은 일반인

새롭게 사업을 시작하는 개인 사업자

월급 외의 소득을 얻기 시작한 프리랜서 또는 유튜버

자신의 월급이 왜 깎여서 나오는 지 궁금한 직장인

경제적 독립을 준비하는 사회 초년생

143

명

수강생

15

개

수강평

4.7

점

강의 평점

1

개

강의

저희는 정보 격차의 해소를 목표로 하는 정보 디자인 그룹으로, 인간공학과 사용자 경험 디자인을 접목하여 효과적으로 정보를 전달하는 방법을 연구합니다.

전체

21개 ∙ (59분)

3. 세금의 필요성

01:33

4. 담세력

02:18

5. 세금의 정의

02:20

6. 세금의 종류

04:45

7. 소득의 종류

02:56

8. 사업자와 프리랜서

02:21

9. 사업자와 세금

02:26

10. 소득세 내는 법

03:02

11. 세금 계산 흐름

01:36

12. 소득공제와 세액공제

02:18

13. 부가가치세

03:23

14. 면세

04:30

15. 면세사업자와 영세사업자

02:25

전체

15개

4.7

15개의 수강평

수강평 8

∙

평균 평점 5.0

5

[프리랜서를 꿈꾼다면 꼭 들어야할 강의] 개발이나 디자인 공부를 하는 사람이라면 프리랜서에 대한 생각을 한 번 쯤 해보게 됩니다. 그 때를 생각해서라도 들어볼 가치가 충분한 강의입니다. 또, 프리랜서를 중점적으로 세금에 대한 가이드를 알려주지만 회사에서 일을 하는 근로자도 알야아 하는 부분들이 꽤 나옵니다. 기초적인 개념들이라서 굳이 프리랜서가 아닌데 도움이 될까? 라고 걱정 안해도 될 것 같습니다. 저 역시 이제 막 사회생활을 한 사회초년생이지만 저에게도 필요한 개념들이 많았습니다. 또한, 강의의 진행방식(애니메이션 같은 그림)이 이해가 잘되서 좋았습니다. 세금에 대해 전무했지만 기초를 조금 다질 수 있는 계기가 되었습니다. 프리랜서가 아닌 근로자에게 초점을 맞춰서도 세금 강의가 있었으면 싶었습니다. 짧은 시간이었지만 유익한 강의 정말 감사합니다 :)

안녕하세요, Jang Daehyuk님! 도움이 되어 저희 또한 무척 보람됩니다 :) 상세한 후기에 감사드리며, deuxamis.main@gmail.com으로 배송 주소 알려주시면 <후기 작성 이벤트>와 관련하여 도서를 보내드리겠습니다! 다시 한번 감사합니다. ^^

수강평 7

∙

평균 평점 5.0

5

세금 기초에 관한 명료한 강의입니다. 지루하지 않게 잘 설명해주셔서 짧은 시간에 많이 배웠습니다. 지금은 신고할 사업 소득이 없지만, 나중에 세무 관련 업무가 필요할 때 요긴하게 쓰겠습니다. 책도 마음에 듭니다. 감사합니다.

안녕하세요, 교양있는개발자님! 책도 구매해주시고 후기도 꼼꼼하게 남겨주셔서 무척 감사드립니다 :) 혹시 저희가 출판한 책 가운데 원하시는 다른 책이 있다면 deuxamis.main@gmail.com으로 배송 주소 알려주세요. <후기 작성 이벤트>와 관련하여 도서를 보내드리겠습니다! 다시 한번 감사합니다. ^^

수강평 1

∙

평균 평점 5.0

5

세금에 대한 두려움을 없애준 강의! 막상 뭐부터 알아야 할지 몰랐는데 하나하나 쉽게 설명해주십니다. 평소 알고 싶었던 내용도 많았고 특히 중간에 나오는 그림들이 귀여워요 ㅋㅋ 덕분에 더 쉽게 이해되었답니다. 부담 없이 세금에 대해 알고 싶어서 무턱대고 듣기 시작했는데 돈 버는 사람이라면 한 번쯤 고민해본 것에 대해 잘 알려주셨어요. (저는 유튜버는 아니지만 유튜버 부분이 진짜 재미있었어욬ㅋㅋㅋㅋ) 선생님~ 덕분에 세금에 대해 용기가 생겼어요! 감사합니다!!

안녕하세요, Pika chu님! 도움이 되었다니 정말 기쁩니다 :) 소중한 후기에 감사드리며, deuxamis.main@gmail.com으로 배송 주소 알려주시면 <후기 작성 이벤트>와 관련하여 도서를 보내드리겠습니다! 다시 한번 감사합니다. ^^

같은 분야의 다른 강의를 만나보세요!

₩22,000